КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Saving Function

|

|

|

|

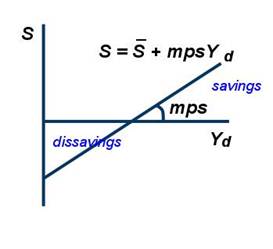

The saving function is the starting point of the Keynesian economics analysis of equilibrium output determination using the injections-leakages model. It captures the relation between saving by the household sector and income. Because income is used for either consumption or saving, the saving function is a complement of the consumption function.

The saving function can be specified as:

S= -c0+(1-mpc)*Y or -c0 +mps*Y

The marginal propensity to save (MPS) refers to the increase in saving (non-purchase of current goods and services) that results from an increase in income.

In other words, the marginal propensity to save is measured as the ratio of the change in saving to the change in income, also giving us a figure between 0 and 1. It is the opposite of the marginal propensity to consume (MPC). In a two sector closed economy

MPS = 1 — MPC

The average propensity to save (APS), also known as the savings ratio, is an economics term that refers to the proportion of income which is saved, usually expressed for household savings as a percentage of total household disposable income. The ratio differs considerably over time and between countries.

The average propensity to save (APS), also known as the savings ratio, is an economics term that refers to the proportion of income which is saved, usually expressed for household savings as a percentage of total household disposable income. The ratio differs considerably over time and between countries.

The savings ratio can be affected by (for example): the proportion of older people, as they have less motivation and capability to save; the rate of inflation, as expectations of rising prices encourage can encourage people to spend now rather than later (monetary base/mass depreciation).

The inverse is the average propensity to consume (APC). Thus

APS + APC = 1

Because spending and saving are two sides of the same decision, saving is affected by the same determinants that affect consumption. Here are a few of the more important ones:

· Interest Rates

· Consumer Confidence

· Physical Wealth

· Financial Wealth

· Inflationary Expectations

|

|

|

|

|

Дата добавления: 2014-01-11; Просмотров: 452; Нарушение авторских прав?; Мы поможем в написании вашей работы!