КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Ex.18. Scan the text bellow and give headlines to each paragraph

|

|

|

|

Ex.17. Discuss the following questions.

1. Why are social arrangements such as markets and property rights necessary?

2. “The economic system of tomorrow is mostly likely to be quite different from the economic system of today.” Do you agree?

3. According to polls, most US economists who classify themselves as liberal favour less government involvement in the economy than the general public does. Can you explain these different approaches?

4. A market system is based on consumer sovereignty – the consumer determines what is to be produced. Yet business decides what is to be produced. Can these two views be reconciled? How? If no, why?

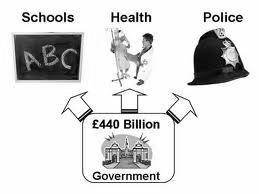

TEXT B: ROLE OF GOVERNMENT IN A FREE-ENTERPRISE ECONOMY

If markets and market systems are so efficient, why let the government tamper with their actions at all? Why not adopt a strict policy of what is called laissez-fair and allow private markets to operate without any government interference? (0) ___________

National defense is one example where the role of government is indispensable because the defense of a nation is a type of good that is completely different from oranges, computers, or housing. People do not pay for each unit they use, but purchase it collectively for the entire nation. Providing defense services to one individual doesn’t mean that there is less defense for others because all people, in effect, consume those defense services together. In fact, these services are even provided to people in a country who don’t want them because there really isn’t an effective way not to. Nations can afford to build jet fighters; neighbourhoods or individuals cannot. (1) ___________ That is why national defense must be administered by the government and paid for through taxes.

Harmful by-products of manufacturing operations, such as the pollution of air, water and soil, are called externalities and often occur where the ownership of a resource, for example air, seas, rivers, public lands, etc., is not held by individuals or private organizations. Most pollution is, in fact, released into the air, oceans, and rivers precisely because there are no individual owners of those resources who have strong personal incentives to hold polluters liable for the damage they do. (2) ___________ Once the government has established an acceptable, or at least, tolerable level of pollution, it can use laws, regulations, fines, special taxes, even jail sentences to reduce the pollution. This is a classic example of a so-called external cost that is not reflected in the price through normal workings of the marketplace. It is called external because – as in the case of a river polluted by a paper-producing company − neither the company nor its customers are bearing the actual cost of paper production. Instead, a portion of the cost − the pollution factor − has been shifted to the people who live or work along the river and those taxpayers who eventually are stuck with the cleanup bill. (3) ___________ Education is often claimed to offer external benefits in a nation because educated workers are more flexible and productive and less likely to become unemployed. That means government’s spending more for public education today may ultimately lead to savings in public and private spending to fight crime, poverty, and other social problems, as well as increasing the skill level, flexibility, and productivity of the workforce.

Governments in market economies must establish and protect the right to private property and to the economic gains derived from the use of that property. (4) ___________ The government's protection of private property obviously extends to land, factories, stores, and other tangible goods, but it also extends to so-called intellectual property: the products of people's minds as expressed in books and other writings, the visual arts, films, scientific inventions, engineering designs, pharmaceuticals, and computer software programmes.

Some people do not have the skills or other resources to earn a living in a market economy. Others benefit greatly from inherited wealth and talents, or from the business, social, and political connections of their families and friends. Governments in market economies inevitably engage in programmes that redistribute income, and they often do so with the explicit intention of making tax policies and the after-tax distribution of income fairer. Governments in virtually all market economies provide support for the unemployed, medical care for the poor, and pension benefits for retired persons. Taken together, these programmes provide what is sometimes called a "social safety net." (5) ___________

Governments in market economies play critical roles in providing the economic conditions in which the marketplace of private enterprise can function most effectively. (6) ___________ Besides, governments have developed a standard set of stabilization policies − known as fiscal and monetary policies − that they can use to try to moderate (or ideally to eliminate) periods of economic recession and slump. Fiscal policies employ government spending and tax programmes to stimulate the national economy in times of high unemployment and low inflation, or to slow it down in times of high inflation and low unemployment. To stimulate the overall level of spending, production, and employment, the government itself will spend more and tax less, even if it incurs a deficit. Monetary policy involves changes in a nation's supply of money and the availability of credit. To increase spending in times of high unemployment and low inflation, policymakers increase the supply of money, which lowers interest rates (that is, reduces the price of money), thereby making it easier for banks to make more loans. This encourages more spending on consumption by putting additional money in people's hands. Lower interest rates also stimulate investment spending by businesses seeking to expand and hire more workers. In a period of high inflation and low unemployment, by contrast, policymakers can cool down the economy by raising interest rates; thereby reducing the supply of money and the availability of credit. (7) ___________

|

|

|

|

|

Дата добавления: 2014-11-29; Просмотров: 606; Нарушение авторских прав?; Мы поможем в написании вашей работы!