КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Reading. Ex.21. Answer the following questions

|

|

|

|

Before reading

Ex.21. Answer the following questions. Refer to the text if needed.

Ex.20. Read the text again and decide whether the following statements are true (T) or false (F). Correct the false statements.

1. Government can control the economy in a number of ways.

2. Income tax is an example of indirect taxation.

3. Taxes are not levied on partnerships and personal incomes.

4. National Insurance is the major source of funds used by the government to provide pensions and jobseekers' allowances.

5. VAT is added to absolutely all goods.

6. HMRC has developed effective communication systems for efficient tax collection.

7. Self-employed people choose a date for paying tax themselves.

8. Citizens can use a hotline to report anyone evading paying tax.

1. What ways does the British government use to control the economy?

2. What is the difference between direct and indirect taxation?

3. What funds apart from tax revenues does the government use to provide social benefits?

4. What goods are zero-rated? What does it mean?

5. What communication systems does HMRC use to provide the efficient collection of taxes?

6. Are there any deadlines for paying taxes?

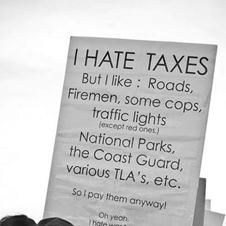

TEXT C: T AXES ARE GOOD

Can you anticipate what arguments the author will use in favour of paying taxes?

Read an extract from governmentisgood.com – a web project of Douglas J. Amy, Professor of Politics at Mount Holyoke College, and do the tasks following the text.

(1) Oliver Wendell Holmes, an American physician, poet, professor, lecturer, and author (1809 – 1894), once said: 'I like to pay taxes. With them I buy civilization.'

(2) Most conservative criticisms about the ill-effects of taxes are exaggerated or untrue. Taxes are in fact good – they are dues we pay to enjoy the numerous vital benefits that government provides for our society.

(3) One of the reasons that some Americans do not have this more positive view of taxes is that they seem to ignore the basic connection between taxes and the beneficial programs they fund. What else could explain the fact that polls repeatedly reveal that many people support tax cuts while at the same time they support increasing government spending in many areas? Naturally, anti-government and anti-tax advocates like to encourage this sense of disconnection between taxes and programs. That is why, for example, when conservatives talk about tax cuts, they rarely talk about the programs cuts that must necessarily follow. They focus on how money will be returned to tax payers, not how money will be taken away from needed government programs. To listen to them, tax cuts are all gains and no pain.

(4) This sense of disconnection is also helped along greatly by the political illusion that the benefits of many government programs are elusive and are often easy to ignore or take for granted. Unlike marketplace transactions, where what we get for our money is immediate and tangible – what we get for our taxes is often delayed and less tangible. When we draw clean water from our taps, we rarely stop to make the connection between this and the taxes we pay to ensure the purity of this vital resource. Also, many of the benefits that come to us from our taxes take the form of things that do not happen to us – like not getting mugged or not breathing dirty air – and these we hardly notice at all.

(5) Anti-government conservatives and libertarians are very good at taking advantage of the fact that while what government does for us often seems elusive, the taxes we pay to government are all too real to most people. Consider, for example, the strategy employed by Arnold Schwarzenegger when he was running for governor of California. In his campaign, he complained loudly about how overtaxed Californians were: “From the time they get up in the morning and flush the toilet, they are taxed. When they go get a coffee, they are taxed. When they get in their car, they are taxed. When they go to the gas station, they are taxed. When they go to lunch, they are taxed. This goes on all day long. Tax. Tax. Tax. Tax. Tax.” This is true – and it helped Schwarzenegger get elected – but it is a misleading half-truth. He leaves out the rest of the story: that we are also constantly benefiting from government programs throughout our day. He deliberately ignores the connection between taxes and the programs they fund. We may be taxed when we flush the toilet, but what we get is the efficient and easy way to dispose of our waste in a manner that does not poison our water or spread disease. We may be taxed when we buy a cup of coffee, but our taxes help pay for inspections of coffee houses and restaurants that ensure that their food and drinks are fit for human consumption. We may be taxed when we pay for gas, but what we get is the interstate highway system that many of us so frequently use. So the reality is really this: Tax. Benefit. Tax. Benefit. Tax. Benefit. Tax. Benefit. While government may be constantly taking from us in the form of taxes, it is also constantly giving back to us in the form of the various programs that improve our daily lives.

(6) Government bashers like Schwarzenegger can only succeed in making taxes seem onerous and unfair by completely ignoring what we get in return. This tactic may be bogus, but it has been a raging success. Conservatives have been winning this ideological fight in the United States in part because they have convinced most Americans to see themselves primarily as “taxpayers” not “beneficiaries.” In their rhetoric, they make sure to constantly refer to people as “taxpayers.” This is another attempt to frame the issue in a way that encourages us to think of government as bad – as a burden on us. “Taxpayers” is not a neutral term at all, but one loaded with powerful political meaning. It unconsciously reinforces a view of citizen/government relations being one-way – from our wallets to its coffers. A recent poll revealed that 28% of Americans agreed with the statement: “I don’t like paying taxes because the government doesn’t do anything for people like me.” And as long as people continue to see themselves only as taxpayers and not beneficiaries, as long as they ignore the connection between our taxes and what they get back from government, they will be ripe for the picking by those who want to weaken government.

Task 1. Discuss what Oliver Wendell Holmes could mean when he said that with taxes he bought civilization. (para.1)

Task 2. Explain whether “anti-government and anti-tax advocates” (para.3) speak in favour of taxes or against taxes.

Task 3. If something is elusive (para.4), is it

a) very complicated and detailed;

b) difficult or impossible to achieve;

c) well-done and of high quality?

Task 4. How does the author argue with politicians who use anti-tax slogans in their election campaigns? (para.5)

Task 5. What does the author mean by “citizen/government relations being one-way”? (para.6) What disconnection does he focus on in the above text?

|

|

|

|

|

Дата добавления: 2014-11-29; Просмотров: 692; Нарушение авторских прав?; Мы поможем в написании вашей работы!