КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Banking system in the USA

|

|

|

|

READING

DISCUSSION

What do you know about banking in the USA?

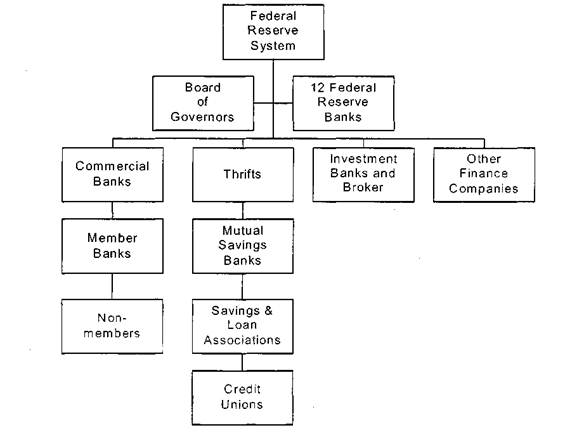

BANKING IN THE UNITED STATES

In 1863 the federal government of the United States started a system of nationally chartered banks that were required to back their notes with federal government securities. In 1913 this system was superseded by the Federal Reserve System.

|

The United States has a dual banking system in which banks supervised by the federal government and banks supervised by the states operate side by side. To open a National Bank one needs a charter from the federal government and to open a state bank a charter from a state. All national banks must, and state banks may (though few do), become Federal Reserve member banks and be regulated by the Federal Reserve. Nearly all banks are members of the Federal Deposit Insurance Corporation (FDIC), which insures their deposits up to $100,000 and also regulates them. About one-third of all U.S. banks are national banks. They hold about 60 percent of all deposits. Frequently, when a bank fails, the FDIC, instead of paying off depositors, merges the failing bank with another bank. In that case even deposits over $100,000 are protected. Traditionally.

The United States has a dual banking system in which banks supervised by the federal government and banks supervised by the states operate side by side. To open a National Bank one needs a charter from the federal government and to open a state bank a charter from a state. All national banks must, and state banks may (though few do), become Federal Reserve member banks and be regulated by the Federal Reserve. Nearly all banks are members of the Federal Deposit Insurance Corporation (FDIC), which insures their deposits up to $100,000 and also regulates them. About one-third of all U.S. banks are national banks. They hold about 60 percent of all deposits. Frequently, when a bank fails, the FDIC, instead of paying off depositors, merges the failing bank with another bank. In that case even deposits over $100,000 are protected. Traditionally.

UNIT 1. BANKING SYSTEMS

19 — 4-789

branch banking has been tightly regulated. Most states limited or altogether prohibited branching, and banks could not open branches in other states. As a result, the United States, unlike most industrialized countries, has a great number of small banks.

The presence of so many commercial banks (around 12,000) in the United States actually reflects regulations that restrict the ability of these financial institutions to open branches (which are additional offices that conduct banking operations). Each state has its own regulations on the type and number of branches that a bank can open. Regulations on the West and East Costs, for example, tend to allow banks to open branches throughout their state, while in the middle part of the country regulations on branching are more restrictive. Some states put limits on the amount of branching permitted. Many small banks in the United States stay in existence because a large bank capable of driving them out of business is often restricted from opening a branch nearby. Indeed, it is often easier for a U.S. bank to open a branch in a foreign country than it is for it to open a branch in another state. Recently the limitations on branch banking have been greatly eased. Within-state branching is now standard, and as of 1991 all states except Hawaii and Montana have entered into compacts with other states, usually in their own regions, that allow bank holding companies located in one of the states to own banks in the other states.

Commercial banks compete with other institutions that offer some of the same services. Savings and loan associations, savings banks (also called mutual savings banks), and credit unions compete with banks for deposits of households and non-profit institutions. Their accounts are also insured up to $100,000 by government agencies. Savings and loan associations and savings banks invest most of their funds in mortgages and compete with commercial banks in this market. Along with credit unions and finance companies, they also compete with banks for consumer loans and are now allowed to make business loans within certain limits.

Money market funds also compete with banks. They invest in very short-term, extremely safe securities and generally allow their customers to write large checks against their accounts.

10 TOP COMMERCIAL BANKS OF THE USA

Bank of America First Interstate

Citicorp Continental Illinois

Chase Manhattan Chemical N.Y.

Manufacturers Hanover First Chicago

J.E Morgan Security Pacific

VOCABULARY to supersede - заміняти, витісняти. charter - ліцензія

|

|

|

|

|

Дата добавления: 2014-12-23; Просмотров: 4882; Нарушение авторских прав?; Мы поможем в написании вашей работы!