КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Lecture 4. Present (or Discounted) Value, Risk and Return Present (or Discounted) Value Risk and Return Using probability distributions to measure Expected Return

|

|

|

|

Present (or Discounted) Value, Risk and Return

- Present (or Discounted) Value

- Risk and Return

- Using probability distributions to measure

- Expected Return and Standard Deviation

- Risk and return at portfolio context

- Risk diversification

Research work:

1. The main financial indicators of Ukraine and Crimea development for the last 5 years (sources!!!)

2. Financial problems of tourism in Crimea

Present (or Discounted) Value (приведенная [текущая, дисконтированная] стоимость [ценность] (сумма ожидаемого в будущем дохода или платежа, дисконтированная на основе той или иной процентной ставки). We all realize that a dollar today is worth more than a dollar to be received one, two, or three years from now. Calculating the present value of future cash flows allows us to place all cash flows on a current footing so that comparisons can be made in terms of today's dollars.

An understanding of the present value concept should enable us to answer a question that was posed earlier: which should you prefer—$1,000 today or $2,000 ten years from today? Assume that both sums are completely certain and your opportunity cost (альтернативная стоимость, цена возможности (стоимость сделанного выбора; эквивалентна выгоде, которую можно было бы получить в случае принятия наилучшего из отвергнутых вариантов) of funds is 8 % per annum (i.e., you could borrow or lend at 8 %). The present worth (текущая стоим) of $1,000 received today is easy—it is worth (стоим) $1,000. However, what is $2,000 received at the end of 10 years worth to you today? We might begin by asking what amount (today) would grow to be $2,000 at the end of 10 years at 8 percent compound interest. This amount is called the present value of $2,000 payable in 10 years, discounted at 8 percent. In present value it rate (capital- problems such as this, the interest rate is also known as the discount rate (or capital rate). Finding the present value (or discounting) is simply the reverse of compounding (начисление сложного процента (расчет будущей стоимости денежных потоков; процесс обратный дисконтированию)).

Therefore, let's first retrieve: FVn = P0(1 + i)n (1)

Rearranging terms, we solve for present value:

PV0 = P0=FVn/(1+i)n =FVn*[1/(1 + i)n] (2)

Note that the term [1/(1 + i)n is simply reciprocal (обратный) of the future value interest factor at i% for n period (FVIFi,n). This reciprocal has own name -the present value interest factor at i% for n periods (PVIFi,n (коэф приведения

PVo= FVn(PVIFi,n) (3)

TABLE 1

Present value interest factor of $1 at i% for n periods (PVIFi,n)

| (PVIFin) =1/(1 + i)n | |||||||

| PERIOD (n) | INTEREST RATE (i) | ||||||

| 1% | 3% | 5% | 8% | 10% | 15% | ||

| 0.990 | 0..971 | 0..952 | 0.926 | 0.909 | 0.870 | ||

| 0.980 | 0..943 | 0..907 | 0.857 | 0.826 | 0.756 | ||

| 0. 971 | 0..915 | 0.864 | 0.794 | 0.751 | 0.658 | ||

| 0.961 | 0..888 | 0..823 | 0.735 | 0.683 | 0..572 | ||

| 0.951 | 0..863 | 0.784 | 0.681 | 0.621 | 0.497 | ||

| 0.942 | 0..837 | 0.746 | 0.630 | 0.564 | 0.432 | ||

| 0.933 | 0..813 | 0.711 | 0.583 | 0.513 | 0..376 | ||

| 0.923 | 0.789 | 0.677 | 0.540 | 0.467 | 0..327 | ||

| 0.914 | 0.766 | 0.645 | 0.500 | 0.424 | 0..284 | ||

| 0.905 | 0.744 | 0.614 | 0.463 | 0.386 | 0..247 | ||

A present value table containing PVIF's for a wide range of interest rates and time periods relieves us of making the calculations. Table 1 is an abbreviated version of one such table. We can now make use the last formula and Table 1 to solve for the present value of $2,000 to be received at the end of 10 years, discounted at 8 percent. In Table 1, the intersection of the 8% column with the 10-years period row pinpoints PVIF 8%10—0.463. This tells us that $1 received 10 years from now is worth roughly 46 cents to us today. Armed with this information, we get

PV0 = FV10(PVIF 8% 10)= $2,000(0.463) = $926

Finally, if we compare this present value amount ($926) to the promise of $1,000 to be received today, we should prefer to take the $1,000. In present value terms we would be better off by $74 ($1,000 - $926).

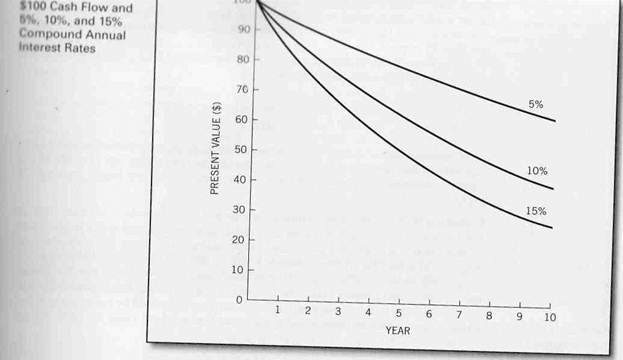

Discounting future cash flows turns out to be very much like the process of handicapping (уравновешивать условия, затруднять). That is, we put future cash flows at a mathematically determined disadvantage relative to current dollars. For example, in the problem just addressed, every future dollar was handicapped to such an extent that each was worth only about 46 cents. The greater the disadvantage assigned (присвоенный, ассигнованный) to a future cash flow, the smaller the corresponding present value interest factor (PVIF). Figure 1 illustrates how both time and discount rate combine to affect present value; the present value of $100 received from 1 to 10 years in the future is graphed for discount rates of 5,10, and 15 percent. The graph shows that the present value of $100 decreases by a decreasing rate the further in the future that it is to be received. The greater the interest rate, of course, the lower the present value but also the more pronounced the curve. At a 15 percent discount rate, $100 to be received 10 years hence is worth only $24.70 today—or roughly 25 cents on the (future) dollar.

|

Return

The return from holding an investment over some period—say, a year—is simply any cash payments received due to ownership, plus the change in market price, divided by the beginning price. You might, for example, buy for $100 a security that would pay $7 in cash to you and be worth $106 one year later. The return would be ($7 + $6)/$100 = 13%. Thus, return comes to you from two sources: income plus any price appreciation (or loss in price).

For common stock we can define one-period return as

R= [Dt+(Pt-Pt-1) ]/ Pt-1 (4)

where R is the actual (expected) return when t refers to a particular time period in the past (future);

Dt is the cash dividend at the end of time period t;

Pt is the stock's price at time period t; and

Pt-1 is the stock's price at time period t -1.

Notice that this formula can be used to determine both actual one-period returns (when based on his topical figures) as well as expected one-period returns (when based on future expected dividends and prices). Also note that the term in parentheses in the numerator of Eq. (5-1) represents the capital gain or loss during the period.

|

|

|

|

Дата добавления: 2014-01-11; Просмотров: 448; Нарушение авторских прав?; Мы поможем в написании вашей работы!