КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Imperfect competition and Monopolistic competition

|

|

|

|

B. Kinked Demand Model

A. Firms behavior in Oligopoly

Oligopoly

Profit Maximization in Monopolistic Competition

Imperfect competition and Monopolistic competition

Lecture 11. Monopolistic Competition and Oligopoly

Regulation

Government Ownership

Government ownership could, in principle, solve the problem, since the government could operate the monopoly efficiently, charging a price equal to marginal cost, and cover the losses out of tax revenues.

In practice, however, government monopolies usually seem to have been operated as "cash cows" for the government, and that's not a solution to the problem of high monopoly prices! It has been quite common around the world (for example) for public telephone monopolies to raise the price of telephone service to pay the deficit of the postal system. Poor telephone service at a high price is the predictable result.

The most common response has been regulation. In this system, a private monopoly is recognized and protected as such, on the condition that it keep its price down below the profit-maximizing level. The monopoly would be allowed to earn a "fair rate of return." Over the years, this was more and more interpreted as meaning that the monopoly would operate at Q2, where the price just covers average cost. This is less efficient than Q1, but better than Q3. However, there are some other complications that led economists and regulators to question this interpretation by the 1960's. In recent years, the trend has been away from regulation.

During in 1933 Edward H. Chamberlin (1899-1967) and Joan Robinson (1903-1983) independently published similar theories on “monopolistic” and “imperfect” competition. The terms “monopolistic competition” and “imperfect competition” originally were basically the same even though there were subtle differences.

Currently, the use of “imperfect competition” is more generic, it refers to all market structures that lie between pure competition and monopoly. In this usage monopolistically competitive and oligopolistic markets are considered imperfect.

Monopolistically competitive markets are characterized by:

– a large number of sellers, no one of which can influence the market,

– differentiated products,

– relative free entry and exit from the market.

Relaxing the characteristic of outputs from homogeneous to “differentiated products” was the basic change from the purely competitive market model. The differentiation of output results in the demand faced by each seller being less than perfectly elastic. Since there are “many sellers,” many substitutes for each seller’s output is implied. This suggests that the demand faced by a firm in a monopolistically competitive market is likely more elastic than in a monopoly. The elasticity obviously depends on the preferences and behavior of the buyers. The negative slope of a firm’s demand function in imperfect competition results in a different result than in pure competition.

The conditions of entry and exit to and from a monopolistically competitive market are similar to the purely competitive market; there are no major BTE (barrier to enter). Entry and exit are relatively easy. The relative ease of entry/exit makes the long run results of an imperfectly competitive market different from a monopoly.

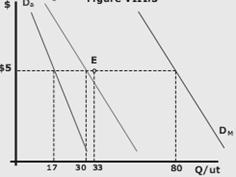

The market demand is the result of a horizontal summation of the individual buyer’s demand functions. The market demand function can be divided among the sellers. A simplified example is shown in Figure 1. The demand for one or all firms’ products would necessarily shift to the left (decrease in demand) by the same number of units that the entrant (firm C) would sell at that price.

The entry of firms will mean each existing firm will have a smaller share of the market and are faced by more substitutes. Entry implies that the demand each firm faces for its product will decrease (shift to the left) and become relatively more elastic at each price.

Each firm would like to capture a larger share of the market and make the demand for its product more inelastic. Advertising is an attempt to alter buyers’ perceptions and increase the demand. Economists identify two types of advertising: informative and persuasive.

Informative advertising provides buyers with information about availability, features and relative prices. It helps the market to perform allocation processes. Persuasive advertising is an attempt to alter preference functions. Driving a new SUV makes one a member of the right social group. Smoking a (given brand) makes one sexier or more macho, independent or whatever. It is not clear that persuasive advertising improves the ability of the market to allocate resources. It must also be noted that advertising increases the costs of the firm and alters the output decisions and profits.

|

|

|

|

|

Дата добавления: 2014-01-11; Просмотров: 702; Нарушение авторских прав?; Мы поможем в написании вашей работы!