КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Retailing 1 страница

|

|

|

|

| 6.3.A Analysis | Warehouse clubs Listen to the tape recording of a marketer talking about warehouse clubs in America. Answer the following questions. 1 Supply the following figures: a The percentage discount offered by warehouse clubs compared with prices in other retail outlets. b The number of warehouse clubs in the USA. c Total expected sales this year. d Inventory turnover by successful warehouse clubs. e The cost of becoming a member of a warehouse club. f The club's gross margin. g The percentage of purchases made by business customers. 2 Identify six factors which enable warehouse clubs to offer such huge discounts. 3 What impact have warehouse clubs had on retailing generally, and why? | |||||

| 6.3.B Vocabulary |

Adjectives

I In each of the following sentences replace the words in italics with a more complex adjective from the list below.

1 Bicorex plc is facing very hard competition. 2 Sales were very slow last year. 3 A very important decision was made. 4 He made a very big mistake. 5 This product only has a very small chance of succeeding. 6 My job is very nice. 7 She is a very good salesperson. 8 He had a very strong desire to buy a sports car. 9 It's very convenient to shop at the local supermarket. 10 Our sales approach is very small. 11 A new price war could be very damaging. 12 I refuse to allow you to embark on this extremely risky venture. 13 Our salespeople have become too casual about their work.

2 What images do the complex adjectives convey to you in the context of the above sentences? Portray one of the sentences pictorially for use with an overhead projector. |

Retailing

| 6.3.C Grammar | Word transformation

I Complete the following sentences by transforming the words in italics.

Example

1 Our chain of distribute is too long; we ought to cut out the middleman. 2 A short of top marketing executives has made recruitment pretty difficult. 3 Yuppies tend to find this product rather appeal. 4 Government regulate require all ingredients to be clearly displayed on the label. 5 The grow of hypermarkets has led to an increasing concentrate of powerful retailers. 6 We simply can't competition with them on price. 7 Our sell figures are down by 3.5%. 8 We'll have to make some alter if the campaign is to succeed. 9 The Japanese simply production better quality goods. 10 We've made a size increase in our market share. 11 New patterns of consume have evolved over the past few years. 12 The sell are always polite and helpful. 13 We're expecting a slight reduce in orders next month. 14 Consume are increase fed up with being given misleading information. 15 This advertise will be broadcast on all the commerce television networks in the Fall. 16 People's net dispose income has steadily risen since the war. 17 We've made several interesting scientific discover but have been unable to transform them into market products. 18 It would be much more economy to buy them in bulk. 19 Our next step is to conquest the Australian market. 20 We need to diverse our product range.

2 Write a short paragraph using five of the untransformed words in italics.

| |

6.3.D

Listening

| A shopping mall Listen to the tape recording of a talk about a large shopping mall in Los Angeles and answer these questions. 1 What five changes in post-war American society led to the creation of the first shopping malls? 2 What did Victor Gruen hope that the shopping mall would achieve? 3 What facilities can be found at this LA mall? 4 How does the layout of the mall encourage customers to spend more money than planned? 5 Apart from being convenient and offering a wide range of products and amenities, what other advantages does this mall offer? 6 In what way can this mall be considered a fantasy land? |

Part II Marketing Unit 6 Retailing and merchandising

| 6.3.E Discussion | The future of retailing In small groups, discuss the changes which you foresee in retailing in your country over the next 20 years. Use the following points to guide your discussion: · the decline/disappearance of some retail outlets · the appearance/growth of other retail outlets · changes in location of retail outlets · changes in consumption patterns (frequency of shopping, growth of new products, etc) · government regulations and deregulations demographic trends, economic growth, development of infrastructure and so on. |

Company focus

| COMPANY FOCUS Marketing at United Distillers The following extracts are taken from Guinness plc's annual report for 1991. Read them and then answer the questions which follow. |

UNITED DISTILLERS

United Distillers, the spirits company of Guinness PLC, produces and markets premium quality, world-famous brands. It is the international leader in both the Scotch whisky and gin industries, and is the world's largest and most profitable spirits company.

The company employs nearly 11,000 people worldwide. It has a portfolio of leading brands of Scotch whisky, gin, bourbon, vodka, rum and other spirits. More than 50 million cases are sold annually.

United Distillers' international sales and marketing headquarters is at Landmark House, Hammersmith, London. Distillers House, Ellersly Road, Edinburgh, is the headquarters for UK production. United Distillers has four geographical regions: Europe, North America, Asia/Pacific and International (rest of the world), with an Operations Group responsible for UK production.

In overseas markets the company owns sales and marketing companies, has joint ventures, notably with LVMH (Moët Hennessy Louis Vuitton), and has direct control over 80% of its brands distribution. It also produces spirits locally, either directly or through third party arrangements.

PERFORMANCE

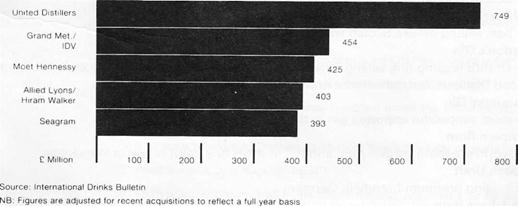

The Top Five Wines & Spirits Companies in the World

(Operating Profit - 1991)

|

Part II Marketing Unit 6 Retailing and merchandising

| UNITED DISTILLERS' PRINCIPAL BRANDS - 1991 World Spirits 1991 Ranking Brand Volume in millions of nine liter cases 4………………….Johnnie Walker Red Label……………………………………………………...…….....6.6 5..................................................Gordon's Gin........................................................................................6.4 15..................................................Bell's.....................................................................................................4.0 28................................................Dewar's White Label............................................................................3.0 29.............................................Johnnie Walker Black Label..................................................................2.9 39..............................................Gordon's Vodka....................................................................................2.4 54...............................................Pampero Rum.......................................................................................2.0 58...............................................White Horse Fine Old...........................................................................1.9 81................................................Tanqueray Gin......................................................................................1.4 86................................................Skol (vodka)..........................................................................................1.3 91.............................................Asbach Uralt (German brandy)............................................................1.3 Source: Impact International January 1992 (Volumes measured are shipments not customer sales.) KEY BRANDS United Distillers' comprehensive portfolio includes internationally famous brand names such as: Johnnie Walker Red Label the world's best selling Scotch and the leading duty free spirits brand worldwide. Johnnie Walker Black Label the world's best selling deluxe Scotch whisky, and the world's third largest duty free spirits brand. Bell's Extra Special the best selling Scotch whisky in the UK and South Africa. Dewar's White Label the best selling Scotch whisky in the USA, and the fifth largest Scotch brand in the world. White Horse Fine Old the best selling Scotch whisky in Japan, and the seventh largest Scotch brand in the world. I W Harper the best selling bourbon whiskey in Japan. Old Parr the best selling deluxe Scotch whisky in Japan. Gordon's Gin the world's leading gin, selling 50% more volume than its nearest gin competitor, and United Distillers' largest volume brand. Tanqueray Gin the most successful imported gin in the USA. Pampero Rum the world's leading golden rum, and the number one spirit brand in Venezuela. Asbach Uralt the leading premium brandy in Germany. Bundaberg Rum the biggest spirits brand in Australia. |

Company focus

| United Distillers is the largest company in the Scotch whisky industry and during 1991 continued to strengthen this position with the rejuvenation and range development of key brands. Johnnie Walker, the world's best selling Scotch whisky, is United Distillers' flagship brand. The Company has now established a broad range of Johnnie Walker products, at carefully selected positioning and price points. Red Label is the brand's premium standard Scotch. Black Label its 12-year-old de luxe, while Swing is positioned at the top end of the de luxe sector. Following a successful launch into duty free. Premier was introduced into Asia Pacific domestic markets during 1991 at XO cognac price level, and the top of the range is Johnnie Walker Blue Label, selling at over $100 in prestige outlets only. To reinforce the brand's unique role in golf sponsorship, the inaugural Johnnie Walker World Championship was held in Jamaica. This annual event, which is the play-off between the winners of the season's leading tournaments, generated considerable worldwide interest and is to be held again in Jamaica in December 1992. Old Parr has been the leading de luxe Scotch whisky in Japan for many years, with considerable sales in Latin America too. The brand takes its name from the legendary figure of Thomas Parr who, it was claimed, lived to the age of 152, through the reigns of 10 monarchs from 1483-1635. Old Parr's premium range extension. Old Parr Superior, continues to build sales steadily in both Japan and duty free. Old Parr Tribute, presented in a ceramic bottle, took the brand into the premium duty free gift market. Old Parr Elizabethan, only available in duty free, is the flagship of the range, selling at over $700, enhancing the prestigious | image of the Old Parr brand and of Scotch whisky overall. White Horse is another of the world's top selling Scotch whiskies. It is the premium brand leader in Japan as well as having a strong customer franchise in the UK, South America and continental Europe. During the year, the brand has undergone a major repackaging following extensive research in its key markets. This has led to the introduction of a more distinctive bottle which reflects the quality the consumer expects of this brand. In Japan, a new bottle with an 8-year-old blend has been introduced for that market alone. White Horse also has an extended range in the Japanese market, where White Horse Extra Fine, positioned between the standard and de luxe categories, has shown good growth. Additionally, Glen Elgin, a single malt, was launched under the White Horse brand name. Its launch reflects the increasing interest in malts in Japan. United Distillers continued to develop its other single malt brands. The Classic Malts -six premium-priced malts representing the different whisky-producing regions of Scotland -have extended their distribution from duty free to major European markets and the USA Cardhu's packaging was upgraded to enhance its unique positioning. Locally-bottled Scotch also fulfils an important role in extending United Distiller's coverage of the overall Scotch whisky market. The launch of Usher's Green Stripe was an outstanding success in Venezuela in providing an opportunity to trade up from national whiskies. Scoresby, recently acquired as part of the Glen-more portfolio and locally bottled in the USA, is now the fourth largest Scotch whisky in that market. |

1 How has United Distillers segmented its markets both geographically and in terms of quality and image?

2 What role does Old Parr Elizabethan play in the Old Parr product range?

3 How much importance does United Distillers attach to packaging?

4 Why do you think Glen Elgin was launched under the White Horse brand name?

5 In which way is United Distillers much more than a producer of spirits?

6 What is meant by a 'flagship brand'?

7 From what you have read in the above extracts and from your background knowledge, describe the ways in which United Distillers have achieved a coherent and successful Marketing Mix.

| PART III |

Finance

UNIT 7

Raising capital

Section I

The sources of funds

| 7.I.A Warm-up | National projects In small groups discuss the following questions: 1 What large projects are currently being carried out or have recently been carried out in your country? 2 How are these projects being financed? 3 Do you know of any small projects and if so, how are these being financed? |

| 7.I.B Reading | Raising capital Read the following passage and answer the questions which follow it. In order to meet the day-to-day expenses of running a business and to acquire new assets, companies need to raise funds. Financing day-to-day operations such as buying inventory or paying wages are very different from financing a project that may only bear fruit in five years time. Consequently, financial matters are often discussed in terms of different time periods. Short-term finance A company's revenues don't always come in at exactly the same rate as the bills which have to be paid. To avoid having a negative cash flow the company may need to take on some short-term debt which would be repaid within one year. The main sources of short-term financing are as follows: trade credit is obtained by the purchaser directly from the supplier and in most countries is the most widespread source of short-term financing for business. The terms of the trade credit vary according to the amount of credit required and the company’s credit rating. Some suppliers may offer their customers 30 days or 60 days of interest-free credit on a handshake. This is known as open-book credit. Hire purchase is another kind of trade credit. In This case the customer takes possession of the goods immediately in return for a deposit plus regular installments. Other suppliers prefer a written agreement, called a promissory note, whereby the customer (who initiates it) promises to repay a fixed sum of money plus interest on a specified date in return for immediate credit. Another type of trade credit is a trade draft which is similar to the promissory note except that it is drawn up by the supplier and not the customer. Trade drafts are particularly useful when dealing with foreign customers whose credit ratings are difficult to check. Short-term loans may be obtained from a commercial bank or a finance company which charges interest depending on the borrower's creditworthiness. A secured loan is a loan backed by collateral, which is an asset such as property, |

The sources of funds

| inventory or accounts receivable (amounts owed by customers). If the borrower fails to repay the loan, the lender may seize the asset. Businesses may also be able to sell accounts receivable to a financial institution. This is known as factoring and tends to be a relatively expensive way of raising short-term capital. An unsecured loan requires no collateral. However, the lender may require the borrower to maintain a minimum amount of money at the bank while the loan is outstanding. This is known as a compensating balance. Although the borrower pays interest on the full amount of the loan, a portion of it remains on deposit at the bank. Another important type of unsecured loan is an overdraft, or line of credit, whereby the business may borrow an agreed-on maximum amount of money without having to negotiate each time with the bank. Commercial paper is a financing option which is mainly for large corporations with top credit ratings. In order to finance short-term projects a corporation may sell commercial paper to another business which will pay less than its face value. At the end of the stipulated period the corporation will buy back the commercial paper at full face value, the difference between the discounted price and the face value being the equivalent of interest on a loan. Long-term finance In order to finance long-term projects such as major construction, acquisition of other companies, and R&D projects, companies can turn to both internal and external sources of capital. The chief internal source is retained earnings which is the money kept by the firm after meeting its expenses and distributing a portion of the profits to investors. Retained earnings are also known as ploughed-back profits or reserves. Another source of capital is to sell assets such as real estate. External sources of capital may be divided into two broad categories: debt capital (which must be repaid) and equity capital (which represents investors' shares of ownership in the company). There are three kinds of debt capital: Long-term loans are repaid over a period of five years or more and may be either secured or unsecured. Collateral on a secured loan is usually in the form of a mortgage. Leasing is a source of long-term capital whereby a company borrows an item (a machine, a building, a vehicle) in exchange for regular payments. The leasing arrangement often includes an option to buy. Bonds are transferable certificates that pay interest regularly for the term of the loan and may be either secured or unsecured. Unsecured bonds are called debentures. As far as equity capital is concerned, the source of equity for a small company is often a single individual such as a member of the family or a venture capitalist. In partnerships, a new partner may be brought in thus providing a fresh source of equity. In larger businesses equity may be raised though the Stock Exchange where shares are issued to investors on the open market. In each case the investor owns a share in the business and expects a share in the profits. |

1 What is the difference between:

a debt capital and equity capital?

b leasing and hire purchase?

c secured bonds and debentures?

d interest and dividends?

e open-book credit and promissory notes?

Part III Finance Unit 7 Raising capital

| 7.I.C Presenting | Using overheads In making oral presentations it is essential to convey important information visually, using slides or an overhead projector wherever possible. The keys to successful visuals are simplicity and clarity. It also helps if your visuals are eye-catching. Imagine you have been asked to present an outline of the text on page 90 to a group of trainee managers. Draw up a chart which could be used on an overhead projector to convey the main points of the text visually. |

| 7.I.D Vocabulary | Defining key terms I Match the following key terms with their definitions: |

| Terms 1asset 2inventory 3cash flow 4credit rating 5trade credit 6open book credit 7promissory note 8trade draft 9secured loan 10hire purchase 11collateral 12factoring 13unsecured loan 14compensating balance 15line of credit/ overdraft 16accounts receivable 17commercial paper 18retained earnings 19mortgage 20lease 21bond 22debentures 23junk bonds 24dividends 25equity 26Stock Exchange | Definitions a a loan agreement whereby the lender has a legal claim on the borrower's property if repayments are not made as specified b payments to shareholders from a company's earnings c the degree of risk a borrower represents d valuable things owned by a company e payment terms whereby the purchaser takes possession of the goods and pays for them later f payment terms whereby the purchaser takes possession of the goods upon payment of a deposit and regular installments g a company's promise to pay back a stated amount of money on a given date less than one year from the time of issue h an order to pay a stated amount of money within a certain number of days, drawn up by the creditor i an unconditional written promise to repay a certain sum of money on a specified date, drawn up by the customer j money owed by customers k a legal agreement whereby the user of an asset pays the owner in exchange for using the asset l bonds that are not backed by specific assets m a market where stocks and bonds are traded n bonds that pay a high interest rate because of the low credit rating of the borrower o a loan granted on the basis of the borrower's credit rating rather than on the basis of collateral p a tangible asset that a lender can claim if a borrower defaults on a loan q the net increase in assets which can be ploughed back into the business r goods held in stock for the production process or for sale to final customers s a loan backed up with something of value that the lender can claim in case of default t the portion of an unsecured loan that is kept on deposit at the bank u the amount of money entering and leaving a business v an unsecured short-term loan made available up to a certain amount w funds obtained by selling shares of ownership in the company x a certificate of indebtedness sold to raise funds y credit obtained by the purchaser directly from the supplier z the buying of accounts receivable at a discount |

| 2 Divide into two teams. Each member of each team reads aloud a definition and asks one member of the opposing team to give the corresponding term. The person answering must not consult his or her notes and has five seconds to answer in order to earn a point. |

The sources of funds

| 7.I.E Discussion | Sources of funds: pros and cons From what you have read in exercise 7.I.B and from your background knowledge list the possible advantages and disadvantages of raising funds through the following sources: | |||||||||||||

| 1 open-book credit 2 promissory notes 3 trade drafts 4 secured loans 5 unsecured loans | 6 commercial paper 7 long-term loans 8 leasing 9 bonds 10 equity | |||||||||||||

| 7.I.E Role play | Giving and getting information Work in pairs sitting back-to-back. One of you plays Role A and the other Role B. Role A You have just received your monthly bank statement as shown in Figure 18. Unfortunately, it was poorly printed and some important information is missing. Phone your bank and ask them to give you the missing information. | |||||||||||||

Figure 18:

Monthly bank statement for Role A

| ||||||||||||||

| You paid in a cheque last week for £450 but this does not appear on the statement. Ask the bank why not. You also want an explanation for the high bank charges and say that generally you are unsatisfied with the bank's service. |

Part III Finance Unit 7 Raising capital

Role B

You are a teller at Eastern Bank. You receive a phone call from a customer. Obtain his references, then call up his account on your screen (Figure 19) and give him the information he requires.

Figure 19:

Monthly bank statement for Role B

| E A S T E R N B A N K Westbourne Mr JAMES PEACH 13 Orchard Ave WESTCLIFFE, DORSET | Tel. 0202 778925 STATEMENT OF ACCOUNT A/C No 906243077 31. JAN 93 Post No 14 | |||

| DETAILS | PAYMENT | RECEIPTS | DATE | BALANCE |

| Balance forward Cash withdrawal Nego. of us chq Card: happy eater Card: wine and dine Salary credit STO: elect STO: mortgage DDR: nothern assurance Cheque 373214 Cheque 373215 Cheque 373218 Cheque 373221 Dr Bank charges DR | 1 300.00 27.5 31.25 102.00 876.00 300.00 76.25 1 032.50 415.00 372.50 18.00 | 47.25 1 745.25 | 31.12 2.1 2.1 5.1 6.1 15.1 18.1 18.1 18.1 2.1 5.1 20.1 22.1 -490.50 31.1 31.1 | 1 460.00 160.00 207.25 179.75 148.5 1 893.75 1 791.75 1 75.75 1 405.75 1 329.50 297.00 -118.00 -490.50 -508.50 |

| Abbreviations: | DIV Dividend; STO Standing Order; DDR Direct Debit; DR Overdrawn Balance; CDT Cash Dispenser Transaction; BGC Bank Giro Credit |

After investigation, you find a cheque for £450 was credited to the customer's account this morning. The delay was caused by the regional computer being out of order for 48 hours. The bank charges are for the unauthorized overdraft incurred during the month (£10.00) and the US dollar cheque (£8.00). You offer to make the customer an appointment to see the manager to discuss the service offered by the bank.

The sources of funds

Section 2

The uses of funds

| 7.2.A Discussion | Meeting the company's needs In small groups, discuss what you think would be the likely source or sources of funds in the following cases. Make a copy of the grid and fill it in accordingly. Be ready to justify your decisions. |

|

|

|

|

|

Дата добавления: 2014-12-27; Просмотров: 646; Нарушение авторских прав?; Мы поможем в написании вашей работы!