КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Retailing 4 страница

|

|

|

|

Controlling the cash flow

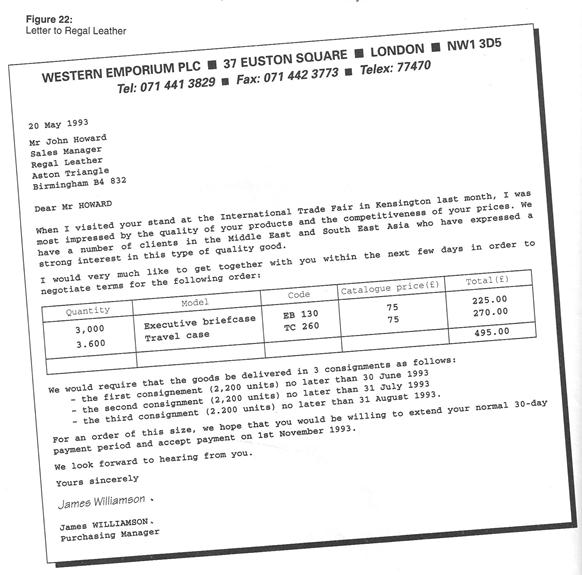

When Mr Jones had finished reading the letter, he put it down, looked up and asked his Sales Manager what he thought of it. 'Great, looks like we've hit a goldmine', exclaimed Howard. 'Maybe', replied Jones, 'but we might just as easily hit a landmine which blows us into bankruptcy'.

Work in pairs and answer the following questions.

1 Find three reasons to explain Mr Jones's apparent lack of enthusiasm.

2 The cost of meeting Western Emporium's order would be as follows (in pounds sterling):

Complete the cash flow forecast below. Receipts of Ј155,000 and Ј40,000 in June and July refer to payments for orders delivered in April and May.

|

| Regal Leather: Cash flow forecast | ||||||

| June | July | August | Sept | Oct | Nov | |

| Receipts Payments Receipts +/- payments Opening balance Closing balance | 155,000 | 40,000 | 63,000 | 123,000 | 505,000 123,000 |

| 3 Analyse your completed cash flow forecast and discuss the problems which it raises. Decide what should be done. 4 Draft a letter to Western Emporium, explaining your position. 5 Hand over your completed letter to another pair who will now play the role of Western Emporium plc. When they have read the letter, try to negotiate a solution which suits both parties. |

Part III Finance Unit 9 Accounting

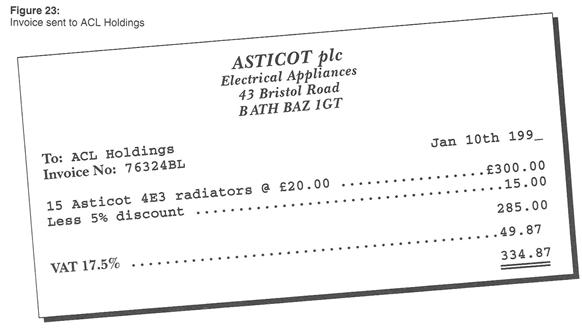

| 9.3.C Writing | Requests and reminders Read the following information about ACL Holdings and then answer the questions which follow. ACL Holdings is normally a good customer, placing regular orders and settling the invoice within 30 days. However, your accounts department has not yet received payment for a consignment delivered six weeks ago. Figure 23 is a copy of the invoice which was sent to ACL Holdings with the consignment. |

| 1 Write a letter of reminder to ACL Holdings. 2 You work in the accounts department of ACL Holdings. Two of your large customers have just gone into liquidation, leaving their accounts outstanding. This has resulted in a temporary liquidity crisis in your company. Reply to Asticot plc explaining your difficulties and requesting an extension of credit. |

Company focus

| COMPANY FOCUS Financial services at Merrill Lynch Read the following extracts from the 1991 Annual Report of Merrill Lynch and answer the questions below. 1 Why is the need for individual savings and investments so great? What is Merrill Lynch doing to meet this need? 2 How important are small to mid-sized business and financial institutions to the American economy? List all the services which Merrill Lynch offers these companies. 3 What were the main economic trends of 1991? What services did Merrill Lynch offer its corporate clients? 4 How are sovereign governments reacting to changes in the economic environment? 5 Why is Merrill Lynch important for states and municipalities? |

MERRIL  LYNCH LYNCH

| |

| INDIVIDUAL CLIENTS | to live longer than ever before. Thus, there has never been more need to save and invest for a comfortable retirement. Nor has it ever been more challenging to finance a child's education, to help with the purchase of a child's first home, or to preserve an estate from one generation to the next. This is especially critical for the 75 million post-war Baby Boomers now approaching middle age, who do not have the same ingrained habits of saving and investing as their parents. The Premier Team of Financial Consultants The key to achieving preeminence in our industry is the Merrill Lynch Financial Consultant. Our FCs, in more than 500 offices in the United States and 28 other countries, are skilled at knowing and anticipating clients' financial needs and at charting the right financial course for each of them. |

| For more than 50 years, Merrill Lynch has led the way in helping people plan their financial futures and in providing the tools and guidance to build, manage and preserve wealth. Through our Financial Consultants, who we believe are the best trained and most professional in the financial service industry, our company delivers the highest level of advice and counsel - along with superior research, investment products, client service, and the Merrill Lynch 'tradition of trust.' Our Financial Consultants focus in bringing added value to the investment process and on developing long-term client relationships. As a result, Merrill Lynch is positioned to play an important role in the years ahead, as vast numbers of Americans and others around the world discover a need to save and invest for the future. In America and elsewhere, people can expect |

Part III Finance Unit 9 Accounting

| Our Financial Consultants draw upon the Merrill Lynch specialists in insurance tax and estate planning, trusts and small business. They are supported by Merrill Lynch's highly ranked Global Securities Research Group. Merrill Lynch clients also benefit from superior products and services. We created such important industry innovations as our pioneering Cash Management Account® (CMA®) and Capital BuilderSM Account (CBA®), and we have the leading market share in accounts of these types. Merrill Lynch clients can choose from a wide array of professional money management services, including more than 120 investment portfolios managed by Merrill Lynch Asset Management (MLAM). Merrill Lynch remains committed to helping educate clients and the public about financial planning and investing. In 1991, over a million people attended seminars conducted by our Financial Consultants, and Merrill Lynch published and distributed extensive educational materials through mailings, seminars, our branch offices and the media. All of this explains why people put their trust in Merrill Lynch. During 1991, total assets in Merrill Lynch client accounts rose 17% to $435 billion - equivalent to an increase of $242 million per business day. The funds in these accounts represent almost 2.5% of all U.S. household financial assets. | financing and retirement planning to evaluating a mature business and developing a plan for its disposition. At the end of 1991, nearly 400,000 small to mid-size businesses and financial institutions had entrusted Merrill Lynch with more than $77 million in assets, an increase of nearly 20% over 1990. In addition, through Merrill Lynch International Inc., our firm provides selected companies with equity, mezzanine and senior financing. Efficient Cash Management and Financing Efficient management of working capital is critical to every business. To make the most of their valuable capital, increasing numbers of businesses are turning to Merrill Lynch's powerful cash management tool, the Working Capital ManagementSM account (WCMS®). The number of these accounts increased 12% in 1991 to more than 100,000 while assets in WCMA and other business accounts increased 17% to more than $32 billion. The WCMA account is superior to other business asset accounts in that it combines all the necessary elements for effective cash management. By combining business checking, borrowing, investing, funds transfer services and charge card processing into a single account, the WCMA frees business owners and managers from many day-to-day cash management chores, giving them more time for hands-on business activities. Moreover, the WCMA account helps businesses bring more revenue to the bottom line by automatically paying down outstanding loans and sweeping excess cash into a variety of money market funds. In 1991, WCMA account began offering electronic charge card processing to retail merchants, chain stores, medical groups and other professional service providers throughout the U.S. Merrill Lynch's superior financial strength has enabled us to continue meeting the borrowing needs of small and mid-size businesses at a time when many traditional lenders are reducing their commitments. | |

| SMALL TO MID-SIZE BUSINESSES AND FINANCIAL INSTITUTIONS | ||

| Merrill Lynch understands the challenges of both expanding and mature businesses. And we also are committed to helping their owners and managers on an individual level. Our firm takes special pride in serving the distinctive needs of small to mid-size businesses and financial institutions. They represent the fastest growing sector of the U.S. economy, accounting for more than 90% of all new jobs created during 1991. Merrill Lynch Business Financial Services is a unique team of professionals dedicated to helping these companies thrive in the years ahead, with innovative financial products and services that give entrepreneurs and managers of smaller companies the same tools available to larger organizations. Working in concert with Merrill Lynch Financial Consultants, our professionals provide a range of services from cash management, | ||

| LARGE CORPORATIONS AND INSTITUTIONAL CLIENTS | ||

| Merrill Lynch's goal is to render the highest level of service to our corporate clients in helping them meet all of their financing and strategic objectives. In 1991, our leadership in virtually all |

Company focus

| facets of the global capital markets - in origination, trading, research and distribution - enabled us to achieve this goal during one of the greatest market surges in history. The year began with the onset of the Gulf War in January and saw the Dow Jones Industrial Average rise from 2,633 to 3,168 by year's end. The NASDAQ Composite Index rose by 57%, and short-term interest rates fell to levels unseen since the 1970s. Corporations around the world rushed to refund high coupon debt and raise additional debt and equity. Worldwide debt and equity financing activity exceeded $868 billion, an increase of 65% over 1990. Merrill Lynch helped its issuing clients achieve their objectives in this favorable environment. Moreover, while the pace of structural change slowed in various world economies - as measured by reduced mergers and acquisition activity - Merrill Lynch continued to be of service in advising clients on acquisitions, divestitures, joint ventures and similar ways of implementing strategic plans. | industries in many parts of the world. Merrill Lynch remains a leader in providing advisory and investment banking services for privatizations worldwide. In fact, we are among the few firms with a leadership position in all the services and market segments needed to evaluate, plan and execute successful privatizations in all regions of the world. Our broad range of skills includes: · Financial advisory expertise · Mergers and acquisitions capability · Restructing and advisory experience · Equity and debt training, underwriting, and distribution capability · Broad and respected global research. | |

| MUNICIPAL FINANCE | ||

| As a leader in municipal finance, with an individual and institutional investor base that has a strong need for tax-saving municipal securities, Merrill Lynch is helping states, municipalities and their political subdivisions solve their most challenging funding needs. During the year, Merrill Lynch lead-managed 339 new municipal issues totaling $16.3 billion, for a nearly 10% market share. To give tax-exempt borrowers greater access to the capital markets at lower cost, Merrill Lynch introduced Floating Auction Tax-ExemptSM/ Residual Interest Tax-ExemptSM Securities, or FLOATSM/RITESSM. These securities, by appealing to both short- and long-term investors, combine to produce an all-in fixed rate of 10 to 30 basis points below traditional long-term fixed-rate alternatives. | ||

| SOVEREIGN GOVERNMENTS | ||

| The capital needs of sovereign governments and supranational organizations worldwide continue to grow, as governments everywhere position their economies to compete in a new environment of liberalized cross-border trade and capital flows. With our strengths in global and domestic capital markets, Merrill Lynch is ideally suited to meet these client needs for financial advisory and underwriting services - to help them in obtaining the lowest-cost capital and in privatizing their state-owned industries. Privatizations Heightened global competition continues to accelerate the sweep toward privatization of government-owned |

| Answers, tapescripts and notes for teachers | |

| 2.3.C | Graphology (tapescript) Many companies nowadays use graphologists as part of their selection procedure. Sometimes the graphologist is asked to analyse the applicants' cover letters as soon as they are received, and screen the applicants accordingly. In other cases the graphologist waits until after the interview before asking the applicant to provide a sample of his or her handwriting for analysis. There are a number of characteristics which graphologists look at to build up a picture of the applicant's personality. The first factor graphologists consider is the layout of the page. They divide up the page spacially so that the bottom of the page symbolises the Earth, while the top symbolises the sky; the left-hand side represents the past, and the right-hand side the future. If, for example, the writing is very close to the left-hand edge of the sheet, it means the writer is conservative and strongly attached to traditional values. A wide left-hand margin, on the other hand, means the individual hasn't yet reconciled himself with his problematic past; he still has a number of hang-ups about his past. Also, the spaces between the letters of a word and between the words themselves is of major importance. A lot of spaces means a desire to communicate, to go towards others, whereas dense, compact handwriting with very few spaces means a desire to occupy all the space, to be overassertive and overbearing and to put up barriers between oneself and others. Another important factor is the size of the actual letters. The size of the letters corresponds to the image which the individual has of himself. Small letters mean that he underestimates himself, either through lack of maturity or lack of confidence, or through simple modesty. Large letters, on the other hand, show enthusiasm and exuberance, but in extreme cases reveal vanity and arrogance. The slope of the lines can be very revealing. Lines which rise show optimism and willpower but if the lines rise very sharply this could mean that the individual is an opportunist or that he's excessive. Lines which fall show sickness, tiredness, depression and lack of self confidence. Next the graphologist considers the pressure of the pen on the paper. A thick line indicates a warm, extrovert individual whereas a thin line means that the person is more analytic and has more depth. A hesitant line, on the other hand, shows apathy and lack of willpower. The slope of the letters is another important clue. Upright letters indicate self-control, individualism and a free-thinking nature. Letters which slope forward show curiosity and ease of integration. Backward-sloping letters, on the other hand, indicate difficulties in adapting to new situations and may mean the writer has a suspicious temperament. Writing which is very regular may be a sign of excessive conformity and rigidity. The graphologist also considers the way the letters are joined. Smooth joins indicate a certain intellectual flexibility and logic. Letters that are badly joined mean that the person needs time to think before he acts. The speed of the handwriting is another important sign. Rapid writing shows intellectual dynamism although if it's too rapid this could indicate a lack of attention for detail. Slow handwriting is more typical of an analytic individual. Very slow handwriting reveals a certain indolence and lack of energy. Another very revealing clue is the shape of the letters themselves. Highly stylised, calligraphic handwriting means a lack of personality and an unhealthy obedience to conventions. Simple handwriting without unnecessary ornaments shows that the individual is frank and simple, with above-average intelligence. On the other hand, complicated handwriting with lots of frills and flourishes shows a certain vanity and artificiality. Angular writing with sharp, stiff shapes means that the writer is energetic, but also intransigent. Round letters reveal a happy-go-lucky individual. However, if the round letters such as the 'o', the 'b' or the 'd' are not closed, this may indicate laziness. |

| 2.2.E | Methods of recruitment and selection (tapescript) 1st recruiter I'm Chairman of the Management Department at a large State University; we've got about 60,000 students altogether, 4,000 of whom are currently studying at the College of Business. When I need to recruit a professor for my department, I first have to send a report to the Dean justifying the recruitment. If the Dean gives her go-ahead, I get together a search committee which draws up a job profile. We're obliged by law to post the vacancy internally, and I also place adverts in the leading management journals and reviews. We might get as many as 30 to 40 applicants for a single vacancy so we then have to sort through the applications and weed out all those who don't have the appropriate background. What we usually do then is phone those people up and advise them that they don't have the right fit. Usually they accept this but if they do insist on an interview anyway, we have to respect their wish as the law forbids us to reject people solely on their written application. We then send teams of interviewers around the country. The interviewers, who are department faculty, work in pairs and spend about 35 to 40 minutes with each applicant. In a sense it's the applicant who interviews us as he or she usually has a lot of questions to ask about the work that'd be expected. After studying the applications in much depth, the search committee short-lists two or three applicants and invites them to spend a couple of days on campus. At the University's expense, of course. During the time they're on campus, the applicants get to meet all the faculty and research students. They present their research, they're entertained by faculty, and then spend some time with the Dean. Then everyone fills in an evaluation sheet, which includes questions on each applicant's personality and cultural fit. The search committee analyses the evaluations, ranks the three applicants and chooses the one who has the highest rank. 2nd recruiter I manage a department store in the centre of London. We've got a permanent, full-time staff of 70 plus 40 or so part-timers who come in at weekends, during the tourist season and just before Christmas. We recruit our sales assistants and cashiers mainly through adverts in the local paper - the Evening News or the Evening Standard, for example. We generally wait until there are at least three or four vacancies before placing an ad and, as a rule, we get between 100 and 200 applications. For permanent positions we prefer to take people with some store experience, although this isn't absolutely essential; experience in selling or demonstrating products might be equally as valid. As far as qualifications are concerned, a school-leaving certificate is normally required, and some knowledge of foreign languages is a definite advantage. On the basis of the written application we reject about two-thirds of the applicants. We invite the others to the store where our supervisors then show them around the various 'departments and answer any questions they may have. We then sit them down and ask them to take a short paper-and-pencil-test which is designed to" reveal their speed and accuracy in solving problems, making simple calculations and using language correctly. While they are doing this our supervisors make a written note of each applicant's physical presentation - the way she's dressed, her physical appearance - and that's about it for the initial contact. We'll then short-list about three times as many applicants as we have vacancies, and interview each of them individually. Actually, it's the store's personnel manager who interviews; I only get to meet them after the final selection has been made and they've started work. 3rd recruiter I'm in charge of human resources for a major publishing house. We publish many of the world's leading titles for corporate decision-makers in the fields of business strategy, international investment, and global marketing. Our recruitment methods depend very much on the kinds of vacancies we have. At the moment, for example, we're in the process of launching a number of important new titles, which has created six vacancies for high-calibre advertising sales executives. We're looking for articulate and motivated people who can deal effectively on the | ||||||||||||||||||||||||||||||

| telephone with prospective advertisers. | |||||||||||||||||||||||||||||||

| For these positions we decided to place a number of advertisements in the national press, under the media and marketing section, giving details of the job and the profile we're seeking. We received about 130 applications, many of which were unsuitable because either the applicants didn't have the necessary experience in advertising sales or the presentation of his or her CV simply wasn't up to scratch; spelling mistakes, typing errors, badly organised cover letters, that kind of thing. We tend to feel that this is a reflection of the person's lack of appropriate communication skills and professionalism and, as a result, we rejected all those which weren't absolutely impeccable. Out of the initial batch we invited 20 to come along for an interview, part of which was based on a simulation exercise. We actually had the candidates ring up a prospective customer (actually, the prospective customer was our deputy sales director) and try to sell her advertising space. We recorded the whole conversation on cassette, and analysed it later on. We also asked each applicant to draft a short business letter to a prospective customer. We're still in the process of sorting through the evaluations we've made, but in view of the quality of some of the applicants, I don't think we'll have much trouble filling these vacancies. I'm hoping to interview the short-listed applicants within the next couple of weeks and will be looking in particular at their level of motivation. | |||||||||||||||||||||||||||||||

| 3.I.D | Motivating employees (tapescript) 1st manager I work for a subsidiary of the Goodyear tyre manufacturing giant in Sydney, Australia. A few years ago, the factory was plagued by absenteeism so that at times our production lines were running at only 74% of capacity. The cost in terms of lost production and non-respect of delivery times was enormous and we realised that something drastic had to be done quickly. Of course, absenteeism isn't peculiar to our company; it's rife throughout Australian industry. It seems to be associated with affluence and the really superb climate so that workers can actually afford to take the occasional day off and go down to the beach even if it means losing a day's pay. If they do need to make up any shortfall in their pay packet they can always work a little bit of overtime. Another thing is that workers in Australia are told exactly how many sick days they're allowed, which of course encourages them to take the maximum number, regardless of whether they're sick or not. Of course, boredom and monotony are also important factors but less so than the reasons I've just mentioned. Anyway, the company decided to tackle the problem by rewarding good workers rather than punishing the bad ones. We sent a letter, hand delivered, to each of the worker's wives explaining that if their husband went to work regularly he would qualify for a prize, such as a diamond ring or a wrist watch. He wouldn't automatically get the prize, of course; each worker was put into a group and would only qualify for the prize if all the members of his group attended work regularly. At the end of the month, those groups who qualified were put into a draw. At the end of the third month, the groups which still qualified were put into a second draw for a colour TV set. The results of the campaign were very impressive - in the short-term, at any rate. In the first few weeks we managed to cut the number of working days lost from 613 to 556 per week and within a couple of months attendance had improved by about 9.6%, though this fell back somewhat when the campaign ended. As far as job boredom goes, the company has introduced a number of activities such as lunchtime concerts to keep the men's minds off their monotonous work. The results seem fairly encouraging though we still have some way to go if we are to achieve our target of running at 95% of our capacity. 2nd Manager I'm Dean of a business school and the problem we had to tackle was how to get our professors more involved in the school. Many of them were, in my opinion, devoting too much of their time and energy to activities which were not directly benefiting the school. Some of them were giving classes in other schools, others were operating as part-time consultants. Some even had their own businesses in things like fashion design, import/ export and market research. Many of them just came in to give their lessons and would then disappear for the rest of the day, although they were actually being paid full-time. I suppose their main motivation here was financial, though some genuinely needed something more challenging than the school was offering. So the first thing I did when I became Dean was to insist on professors devoting their working hours exclusively to the school. If they want to work elsewhere they may do so, of course, but in their own time - in the evening or at weekends, for example. Or they can choose to work here part-time, and be paid pro rata. What they do for the rest of week is their own concern. Secondly, I set up an annual commission to evaluate each professor's work. At the beginning of the year each professor has to draw up a list of his or her activities for the coming year; the number of classes he or she expects to give, research projects he or she'll be working on, publications, canvassing, development of new programmes, participation in symposiums, continuing education programmes he or she'll be studying on, and so on and so forth. At the end of the year the commission sees to what extent each professor's objectives have been met, and evaluates his work accordingly, both from a quantitative and a qualitative point of view. I, myself, don't sit on the commission. The members of the commission are the professors themselves - some appointed by me, some elected by their peers - and it's they who send me a report on each professor, and this report forms the basis of any future decisions regarding raises and promotions. The system met with a certain amount of resistance initially as some professors felt like Big Brother was watching them all the time. We also had some teething troubles, especially over the criteria for evaluating their performance. But I think we've now ironed out most of the problems and are beginning to transform the school from a small provincial teaching establishment to an internationally recognised institution with a strong research ethic, a highly committed team and a growing presence in the media and business reviews. 3rd Manager I'm head of Human Resources for a car components manufacturer and the problem we were having a while back was high staff turnover. It affected us at all levels but especially among our junior and middle managers. At one point it was getting so bad that we had to replace 15 of our managers in the space of six months. Anyway, we decided to systematically interview everyone as soon as they handed in their notice so that we would get a clearer idea of why they were leaving us. It's amazing how much people will reveal in this kind of interview when they know they've got nothing to lose; they can be totally honest without worrying about the consequences. What emerged from these interviews was that our people, whatever their position in the company, felt they weren't being trusted, It was a kind of vicious circle; the company doesn't trust the employees, so the employees don't trust the company to reward their talent and effort. So either they reduce their commitment by working less hard, or they quit. We therefore decided to develop an atmosphere of mutual trust between top executives and employees, and I don't just mean managers but shop-floor workers as well. We started giving more authority to all employees by letting them have a greater voice in decisions. We figured that anyone who is likely to be affected by a particular decision ought to have the feeling that people want to know how he or she feels. In some cases it's enough to provide employees with a letter box so that they can make their feelings known, either anonymously or not. In other cases employee representatives are allowed to sit in on and actively participate in management meetings. Executives are encouraged to push responsibility down the ladder and delegate more to their immediate subordinates. We've also tried to develop a stronger team spirit in the company by organising a weekly social evening in the bar, where employees at all levels can come and drink and dance and, hopefully, learn to trust each other a little more. The change in attitude among employees is almost palpable. Productivity's up and staff turnover at all levels is down by as much as 10%. | ||||||||||||||||||||||||||||||

| 5.I.E | How an advertising budget is established (tapescript) Today, we're going to talk about four basic methods for establishing an advertising budget. Let's quickly list them on the board. They are: · the affordable method · the percentage of sales method · the competitive parity method and, finally · the objective and task method. Now these are the most popular methods for establishing an advertising budget, but as we shall see, they are not all very logical. Let's begin by having a look at the | ||||||||||||||||||||||||||||||

| strengths and weaknesses of each method. First of all, the affordable method. We will ask for everything the company can afford to give us; if the company had a good year last year, they'll give us a lot; if not, they'll give us a little, or perhaps even nothing at all. The two main weaknesses of this method are that, firstly, it leads to a fluctuating advertising budget over time. And secondly, it makes long-term planning difficult. How can we expect our marketing people to come up with an advertising strategy when they don't know from one year to the next how much money they'll have to play with? The smaller the organisation, the more likely it is to use this method because small organisations don't plan anyway. It's not that they shouldn't, it's that they don't. The main advantage of the affordable method is that the company only spends what it can afford; there's no danger of it overspending. Is everybody clear about the affordable method? Any questions? Right. The second method we're going to look at today is the percentage of sales method. The percentage of sales method is the most popular method. The company's advertising budget is based on the preceding year's sales for the product or products in question. Now, what are the weaknesses of this method? Well, firstly there's a complete absence of theory to justify this method. No model has ever been devised to support it. Secondly, this method leads to circular reasoning; in other words, according to this method, sales are causing advertising rather than the reverse, advertising causing sales. Our advertising shouldn't be a function of what happened in the past but should contribute to sales in the future. That's what we mean by circular reasoning. A third drawback is that this method sets up a vicious circle; if we had a bad year last year, we'll spend less on advertising this year and therefore increase our chances of having another bad year. In other words, the percentage of sales method may prohibit the use of counter-cyclical advertising strategies. OK. Let me explain what we mean by countercyclical advertising strategies. A counter-cyclical advertising strategy means that if sales were down last year we may help to remedy the situation by proper, creative advertising, which may mean spending a correspondingly larger amount than last year, not a smaller amount. Consequently, we may continue to spiral downward. A fourth weakness of the method is this: what percentage of last year's sales should we pick as a reference point? Should it be 1 %, 3% or 4.5%? Should it be the same for all the company's brands? Is there such a thing as a logical fixed percentage? In actual fact, those companies which use this method tend to have a fixed percentage for all their products and this really doesn't make sense, does it, because apart from the fact that this fixed percentage is not logical but arbitrary, the brands which we want to advertise may be in very different stages of evolution. For example, some brands are in the introduction stage of the product life cycle and may require hefty advertising budgets, while others are in the maturity stage. Some brands have been successful, others unsuccessful. There are so many factors that it's crazy to come up with one fixed percentage, never mind deciding what that percentage should be. There are, however, a few positive things to say about the percentage of sales method. It's true, for example, that the company won't get into trouble by overspending; it will only spend what it can afford to spend. Also, this method does encourage management to look at the relationships between advertising costs, selling prices and profits per unit, and this analysis of relationship can be very valuable. A third advantage is that this method, when followed by a lot of companies, may encourage competitive stability, especially when the fixed percentage that companies pick is roughly the same. Competitive stability means that there are no advertising wars and this can be good for the individual firms. Now let's talk now about the third method; the competitive parity method. We find out what our competitors are spending and we attempt to match what they spend. We'd probably look at what four or five of our major competitors spent last year and calculate the average of what they spend, then we'll say That's what we'll spend next year on our advertising'. Now, what's the rationale behind this method? Well, firstly, our competitors' expenditure on advertising ought to represent the collective wisdom of the industry. And secondly, because we do spend about the same amount of money as our competitors, this ought to prevent advertising wars. The problem is that these two assumptions don't hold water. There's no reason to assume that our competitors represent any wisdom at all; they may be as much in the dark as we are. Who's to say they're smarter than we are, that their techniques are more | |||||||||||||||||||||||||||||||

| sophisticated? And as far as preventing advertising wars, well that's nonsense as well because if any of our competitors want to spend more on advertising this year they'll do it. The last method is known as the objective and task method. First of all, let's see what it is. If we can establish what our advertising objectives are, we ought to be able to figure out what we need to do in order to reach those objectives. So, for this to work, we have to be able to do the following: firstly we have to define our advertising objectives as specifically as possible. For example, what is the target market and what do we want our ad to do? Do we want it to inform, to change attitudes, do we want it to reinforce existing attitudes, to encourage buying behavior..? Whatever it is, it must be specified. Then we can go to the second step, which is, 'What specific tasks have to be performed to achieve these objectives?'. For example, if we choose as an advertising objective 'imparting knowledge', in other words we want to teach our target market something new, what do we have to do to get that across? We have to create a theme, a system, whereby we know which media we're going to position our ads in. We have to have our whole creative staff working on the internal characteristics of the ad. And all those activities cost money. So the final step is to estimate the costs of each task and just add them up. Now this may sound easy on paper. It's entirely consistent with marketing theory which says you must establish your general objectives first, learn about the target market, do your segmentation, do your positioning, learn about the competition, then take the whole wealth of information, then, then, establish specific marketing objectives and then advertising objectives. It is very much consistent with that. However, it is the most difficult method to implement and requires a great deal of rigour in order to carry it out successfully. | |||||||||||||||||||||||||||||||

| 6.I.D | The layout of a supermarket (tapescript)

As in most supermarkets nowadays, the check-out desks are situated on the left-hand side of the entrance because customers tend to move down the aisles in an anti-clockwise direction.

The customer enters the supermarket and passes through the fresh fruit and vegetable area where she can select what ever she wants and then weigh the produce on the electronic scales. These are situated just opposite the emergency exit. The scales not only weigh, but price the product automatically, and we've found that this is the fastest and cheapest way of serving customers.

On the right-hand side of the aisle after the emergency exit, there's a self-service counter for cooked meats and poultry. The cheese counter is situated at right-angles to this so that it can be clearly seen as the customer walks down the aisle. We've got a good range of British and Continental cheeses which the customer can have cut fresh from the block.

Just in front of the cheese counter, there's a small floating island of pre-packaged sausage and salamis.

Turning left at the cheese counter, the customer passes by two rows of cleaning products, such as washing-up liquid, soap powder, detergent, furniture polish and floor wax, that kind of thing, then there are four rows for wines, spirits, beer and soft drinks, in that order. These are high-margin products so we've placed them in a very prominent position which every customer has to pass by.

Opposite the drinks department, there's the fish counter which sells a wide range of fresh fish and seafood. This is followed by a special section for fruit juice, UHT milk and mineral water which are all rather bulky, fast-moving products and which therefore require a special area next to the stockroom in order to simplify restocking the shelves.

Opposite that, and backing onto the row of soft drinks, there's one row for toilet paper then one row for babies' nappies. Then, as you can see, there are two rows for canned goods, such as canned fruit, canned vegetables and canned fish, then one row of savoury snacks, you know, crisps, peanuts, salty crackers and so on.

Following on from that, there's one row for flour, rice and pasta followed by a row of health food products, like salt-free biscuits, high-fibre cereals, vitamins and minerals and things to make you live longer if you can afford to pay the price.

Moving on down the aisle, you've got one row for tea and coffee followed by one row of breakfast cereals and children's snacks, including bars of chocolate and packets of sweets.

The next row is given over to jam, marmalade and honey and that's followed by two rows of biscuits. After that, there's one row of pet food, followed by two rows for cooking oils and condiments. The last two rows are for dairy produce such as butter, cheese, margarine and eggs.

On the right-hand side of the aisle, opposite the biscuits, there's the meat counter with two butchers serving full-time, and next to that, right in the corner there's a cooked-meat counter with one sales assistant.

Turning left at the end of the aisle, there are two counters, the one on the left being for frozen food, the one on the right is for dairy produce, such as fresh milk, cream, yogurts, and milk-based desserts.

This is followed by two more frozen-food counters, the one on the left being for pizzas, fish fingers and beef burgers, the right-hand one is for ice-creams and frozen desserts.

Turning left, then, at the emergency exit, you've got the administration offices on your right followed by the sugar section. At right-angles to that, there's the bread and cakes counter, with a wide range of products.

On the other side of the aisle there are eight rows given over to seasonal products such as toys and chocolates at Christmas, or bulbs and seeds in the Spring.

Following on from that, there's one row for small electrical items such as batteries, light bulbs and plugs, then two rows of DIY material and two rows for soaps and cosmetics.

The last five rows are given over to hardware (you know, saucepans, frying pans, pressure cookers, that sort of thing), crockery (cups, plates, saucers and glasses), cutlery, and two rows of electrical goods such as toasters, hairdriers, coffee-makers, clocks and electric shavers.

Back-to-back with the fruit and vegetable counter there's the stationery department where we stock a fairly wide selection of newspapers and magazines, as well as pens, paper and envelopes.

The head cashier's office is on the right of the stationery department, and she keeps an eye on the ten check-out desks in front of her. Her permanent presence is an effective control against check-out desk irregularities.

The layout of the supermarket is of paramount importance in optimising sales. As you can see, we've spread out the location of the basic foodstuffs such as sugar, flour, oil, pasta, milk and bread into various parts of the supermarket so that the consumer has to visit all four corners of the store to get everything she needs, Hopefully, she'll do some impulse shopping on the way.

On average the consumer spends around 20 minutes in the supermarket, which is typical for a store of this size. It's vital that she spends a very limited amount of time purchasing the basic products, and rather more time impulse shopping. In order to encourage this behaviour, we try to keep the traffic moving by having wide, well-lit, well sign-posted aisles.

We also have a number of gondolas at the intersection of two aisles for displays and demonstrations, and of course there are the usual display racks at the check-out desks for small, high-margin articles such as chewing gum and razor blades.

One final point of interest is the use of children's trolleys which, we've noticed, has boosted sales for things like biscuits and sweets.

2 Spreading out of basic products; weil-lit, well-signposted aisles; display racks; floating isles; children's trolleys. Bulky and fast-moving items are given a special area next to the stockroom. Head cashier's office located next to check-out desks. 3 Suggested answers · polish, wax, bleach, sponges · seafood (mussels, shrimps, prawns, oysters) and fish (cod, hake, skate, salmon) · crisps, peanuts, cashew nuts, crackers · cream, yoghurt, milk, eggs, cheese · cups, plates, saucers, mugs. | ||||||||||||||||||||||||||||||

| 6.3.A | Warehouse clubs (tapescript) Over the past few years we've seen an interesting trend developing in American retailing, namely the warehouse club, or cash-and-carry store. Basically, these are enormous stores which offer their members absolute rock-bottom prices on a range of products such as food and household appliances. Prices are typically somewhere between 20% and 40% lower than you'd find in the local supermarket. There are probably around 30 of these warehouse clubs in the US. You'll find them in most of the main towns and their sales this year are expected to reach around $7 billion. They rely on a very rapid turnover of inventory, usually between 15 to 18 times a year, and their gross profit margin is 10%. You have to be a member to buy at one of these clubs, which means paying a $25 annual membership fee. About half of the clubs' sales are to business customers - small shops, restaurants, local factories, that kind of thing. There are many reasons why these warehouse clubs are able to undercut their competitors to such an extent. Firstly, they offer no amenities, I mean these places are really like warehouses - grey walls, shelves going right up to the ceiling, virtually no sales assistants to give advice. And then, of course, they spend practically nothing on advertising; well, they don't really need to, I suppose. Also, they offer a very limited selection of products; they concentrate only on products that they can move quickly which means they've got less capital tied up in inventory. Another big advantage they have is their size and the economies of scale which go with that. For example, their overheads are spread over greater sales, which keeps unit costs down. Similarly, their size means they can be tough in negotiating with suppliers so they get all the best buys. And, finally, because so many of their customers are business people, there's less likelihood of being paid with dud cheques. In spite of all these advantages, though, warehouse clubs are not likely to radically transform American retailing. In fact, their effect has been only minimal because each warehouse club takes only a little away from its competitors, and as there are still relatively few clubs I don't think they'll seriously upset the present status quo - not for the time being anyway. a Between 20% and 40% b About 30 c $7 billion d 15 to 18 times a year e $25 per year f 10% g 50%. 2 no amenities; little advertising; less capital tied up in inventory; fixed costs spread over greater sales; customers less prone to writing bad cheques; clubs look for the best buys and are tough negotiators. 3 Very little impact because there are so few of them and they take only a little away from each competitor. | ||||||||||||||||||||||||||||||

| 6.3.D | A shopping mall (tapescript) The first shopping malls grew up in the immediate post-war period as a response to the deep changes that were taking place in American society. For example, the early 50s saw the greatest spread of suburban life in America, with the middle classes moving out of the city into the suburbs. This was linked, of course, to the tremendous population explosion -the so-called 'baby boom' - and America's increasing affluence. The automobile became affordable by most people so that distances became indifferent. To meet the needs of this huge, affluent population who no longer had the traditional city centres to serve them, a new industry was created; the shopping centre, or mall, as it came to be known. At the same time, American culture went very private, from a communal culture centred around the town square, with the traditional European nineteenth century notions of urbanity, to a very private, very materialistic culture based on consumption. One of the first mall designers was Victor Gruen, and his aim was to provide an identifying focus for suburbia. He saw the mall as an opportunity of giving suburbia a core, a definition. The hope was that the mall would grow into an urban centre, not merely devoted to retailing, and surrounded by cars, but that it would be joined by public facilities, museums, services, even educational facilities. Unfortunately, this didn't come to pass in the 1950s. The first shopping centres became exclusively dictated to by commercial criteria, and it was only in the 80s that mall designers began to incorporate non-commercial amenities. Victor Gruen also saw the mall as a way of dealing with the car in a comprehensive way. The car had always been accommodated either by making wider streets or by making more parking places, or by demolishing buildings to make more parking lots. But usually the pedestrian was the loser in the conflict. So Gruen wanted to create a space where you'd be able to take the car but then forget about it and the mall would then be a space rather like the old public square. This LA mall is a good example of a 1980s model, with a very wide range of facilities. For example, it has the largest indoor water park in the world, with 22 water slides and a wave machine which can generate waves up to six feet high. There are indoor and outdoor suntanning facilities. There's the 'Colorado River Rapids' ride; Fantasyland, with 25 rides and attractions including 'The Daring Drop of Doom'; the highest metal rollercoaster in the world, the 'Perilous Pendulum'. Then there's the deep-sea adventure area with four submarines, dolphins, sharks, alligators, penguins. And when you ride on the submarine you see these animals and many other forms and varieties of underwater wildlife. The mall also has over 100 restaurants, 24 theatres, a zoo, an ice-skating rink, tennis courts, a chapel, an office tower housing dozens of lawyers, doctors, dentists and social workers, not to mention the mall's fifteen major department stores and over 500 other retail outlets. And all this under one roof! You really have to see it to believe it. But despite the introduction of public facilities and services, the mall remains, first and foremost, a giant commercial venture, in fact one of the most powerful marketing mechanisms ever devised. The layout of the mall is designed in such a way as to maximise the chances of each individual shopper spending a maximum amount of money. It does this by transforming destination shoppers into impulse shoppers. For example, suppose you wanted to buy a pair of shoes for your six-year-old daughter. In marketing terms you'd be a 'destination shopper', in other words, a consumer who had come to the mall with a specific purchase in mind. Now, suppose you can't find exactly what you want at the first store you visit; you head off towards another shoe store but on the way you pass by several dozen other stores, cafes, ice-cream parlours, and what have you. By the time you arrive at the second shoe store there's a very good chance you will have bought something on the way which you hadn't originally planned to buy. In other words, you'd have been transformed from a 'destination shopper' into an 'impulse shopper'. The design of the mall also owes a lot to Disneyland, which first introduced the idea of the 'theme environment', where complex reality is reduced to a number of easily understood themes. This idea has been taken up by almost every area of American existence ie shops, restaurants, tourist attractions and leisure facilities - they've all become theme environments so that now we travel in a circuit going from one theme environment to another without ever having to confront the realities of a city in between. And this, of course, is another of the mall's main attractions. In the mall, you don't find the pickpockets, the pushers and the muggers that you'd find in most city centres. The mall is a relatively safe place. The parking lot is monitored by closed-circuit TV cameras, and there are plain-clothed and uniformed security guards who supervise the entire area. Any 'undesirable' elements are quickly moved on, and I don't only mean potential delinquents or hooligans, but homeless people, groups of adolescents and people whose behaviour may be bad for business. In some ways the mall is a world within a world. We've created our own world by taking the outside and putting it inside. We've put the stores inside, and the trees and the animals, so that we can protect it and keep it clean and 'nice' all the time. And we've left all the rest, all the chaos we've created, out on the highway. 1 Mass middle class move from towns to suburbs; population explosion (baby boom); increasing affluence; automobile ownership; cultural shift from 'communal' to 'private'. 2 An identifying focus for suburbia, a core, a definition; an urban centre with a full range of facilities; a way of dealing with the automobile without penalising the pedestrian. 3 Water park; suntanning facilities; rides and attractions; deep-sea adventure area; restaurants; theatres; zoo; ice-skating rink; tennis courts; chapel; lawyers; doctors; dentists; social workers; department stores and other retail outlets. 4 By turning them from destination shoppers into impulse shoppers; by making them pass by a large number of stores before reaching their destination. 5 Safety for people and cars, thanks to very tight supervision by the security forces. 6 There is the 'Fantasyland' area; the mall successfully excludes 'undesirable' aspects of urban reality which might otherwise interfere with customers' happiness. | ||||||||||||||||||||||||||||||

| 8.2.A | The Commodities Exchange Center, New York (tapescript) Welcome to the Commodities Exchange Center. The CEC functions on behalf of the four independent exchanges that trade here. They are: the Coffee, Sugar and Cocoa Exchange, COMEX, the New York Cotton Exchange and the New York Mercantile Exchange. Each of these exchanges trades in a variety of different futures and options contracts. Small maps on the windows in front of you show where the various trading rings of each exchange are located. The trading floor, of course, is where the action takes place. What you're seeing here, is the law of supply and demand freely at work in an open marketplace. What looks like chaos is actually a highly organised process of trading in futures contracts and in options on futures. Like an auction the futures market assures both buyer and seller of the prevailing price at any point in time. This process of price discovery is one of the market's two major economic functions. The other is the shifting of risk from hedgers to speculators. Hedgers represent commercial interests - such as producers, dealers or processors -whose business involves the sale or purchase of the actual commodity. They enter the futures market in order to protect themselves from major fluctuations in the cash price of commodities they plan to buy or sell in the future. Speculators, on the other hand, are investors who are willing to assume the price risks that hedgers want to avoid. They're willing partly because futures contracts are highly leveraged investments and an initially small amount of risk capital - called a margin deposit - can result in a sizeable profit or loss as market prices rise and fall. Speculators add liquidity to the market, and help keep prices competitive although they generally have little interest in possession of the commodity itself. The basic unit of every trade is the futures contract. It specifies the quantity, quality, and month of delivery of a particular commodity. The price of each contract is determined by open outcry between buyer and seller when the contract is traded. Traditionally, futures contracts have been traded on specific physical commodities. These include agricultural commodities like coffee, sugar, cotton or orange juice, metals, such as gold, silver, copper or platinum, and energy products, like gasoline or crude oil. More recently, a number of financial futures have been introduced on the US dollar index, or the consumer price index, for example. Contracts in all four categories - agriculture, metals, energy, and financial futures - are traded here at the Commodities Exchange Center and new contracts are introduced from time to time. In an open marketplace, nothing is quite as constant as change. In addition to the futures contracts themselves options are traded here too. Very briefly, an option on a futures contract conveys the right - but not the obligation - to either buy or sell - depending on the kind of option held - a specific futures contract at a specific price during a specified period of time. Options provide additional trading opportunities for commercial market participants and an alternative approach for the individual investor. As you look at the trading floor, you can see many of the elements of a futures transaction taking place. Let's start with the phone clerks - they're the people you see at telephone and teletype stations all around the floor. A trade is initiated when a customer somewhere in the world calls his commodity broker with an order to buy or sell. The broker transmits that order to the trading floor by teletype or telephone. The phone clerk writes the order on an order ticket - time stamps it to record the exact time it was received - then gives it to a runner, who takes it to a floor broker at the appropriate trading ring - the only place where trading can legally occur. There, the broker executes the order by open outcry, as required by the rules of the exchange so that everyone present can bid or offer and will know the details of each new transaction. Of course when everyone's shouting, it's sometimes hard to hear, so the brokers also use hand signals - palm in to buy, palm out to sell. Once the trade is made, the floor broker notes the details on the order ticket and on his trading card. A runner returns the order ticket to the phone clerk who time stamps it again and then reports the execution of the trade back to the broker who initiated the order. He then notifies his client. At the trading ring, floor reporters employed by the respective exchanges use hand signals to relay the prices of all new trades to recording clerks, stationed in a rostrum near each ring. The recording clerks enter all new prices into the CEC's central computer system. Within seconds, the large electronic display boards all around the sides of the trading floor are automatically updated with the latest price information. Simultaneously, the same information is relayed to video display terminals and newswire services throughout the world. Still the trade isn't quite complete. Back at the trading ring, clerks collect the floor brokers' trading cards periodically, and report the trades to the clearing association for that exchange. There, computers match the buyer and seller for each trade, and any breaks - or unmatched trades - are resolved. At this point, the clearing association assumes the role of opposite party to every transaction as the buyer to every seller and the seller to every buyer. At the end of each business day, the clearing association balances the accounts of each of its members. Futures trading is an exciting, dynamic process, offering the savvy investor an opportunity for highly leveraged profits, providing commercial interest with protection against major price fluctuations and benefiting individual consumers with more stable, competitive prices for the things they buy. What you're watching is a major part of the world economy at work. The display panels above the windows and near the door will tell you more about the activities here at the Commodities Exchange Center. For more information about trading in futures or options, contact one of the individual exchanges. Thank you. 1 Coffee, Sugar and Cocoa Exchange; COMEX (Commodities Exchange); New York Cotton Exchange; New York Mercantile Exchange. 2 On the trading floor. 3 Shifting risk from hedgers to speculators. 4 Representatives of commercial interest producers, dealers, processors. 5 No. Futures contracts are highly leveraged investments. 6 No. He is generally interested in trading the contract (not the commodity itself) at a profit. 7 By open outcry between buyer and seller, as at any auction. 8 US dollar index and consumer price index. 9 The right (but not the obligation) to either buy or sell a specific futures contract at a specific price during a specific period of time. 10 They shout and use hand signals. 11 Electronic display boards; video display terminals; newswire services. Grid: Customer calls commodity broker (CB) with order to buy or sell; CB transmits the order to the trading floor; phone clerk (PC) writes the order on an order ticket; runner (R) takes order to a floor broker (FB) at the appropriate trading ring; FB executes the order by open outcry; FB notes the details of the trade; R returns order ticket to PC; PC stamps ticket again; PC reports execution of trade back to CB; CB notifies client. | ||||||||||||||||||||||||||||||

| 8.2.E | Yesterday's trading at the London Stock Exchange (tapesricpt)

Yesterday's stock market trading saw investors taking a subdued view of prospects for the short-term. With Wall Street looking less confident following last week's US employment data, UK equities spent most of the session on the downside and closed 15.4 points lower on the FT-SE scale at 2,519.9.

Strategists at several leading securities firms suggested that although prospects for a further rise in UK equities before the year-end were still good, the next few months might prove less certain. Some lines of good quality stocks were on offer, suggesting that fund managers are reshaping portfolios.

However, sterling's continued firmness against the German mark raised hopes of a further cut in UK base rates, all the more so as the latest UK retail price index is confidently expected to show a significant fall in domestic inflation.

For much of the day, the equity market was led by activity in the stock index fu

Дата добавления: 2014-12-27; Просмотров: 475; Нарушение авторских прав?; Мы поможем в написании вашей работы! |

Генерация страницы за: 0.011 сек.