КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Retailing 3 страница

|

|

|

|

Part III Finance Unit 8 Investing

| 4 going bankrupt three times, she started up a new company is doing extremely well. 5 She got her MBA and got herself a job on Wall Street meeting her husband. 6 your stay in London, I’d like you to get in touch with Sir Richard Grant in Kensington he could prove to be a useful contact. 7 the Stock Market had begun trading, it was almost too late. we did manage to sell at a fairly reasonable price. 8 his departure, he left this note for you. , he asked me to thank you. |

UNIT 9

Accounting

Section I

Terms and concepts

| 9.I.A Reading | The main concepts and documents Read the following passage and answer the questions which follow it. Businesses measure their financial performance by recording and classifying sales, purchases and other transactions, They then present this information in a way which makes it possible to evaluate their past, present and future performance. The various accounting activities are usually divided into two distinct parts: financial accounting and management accounting. Financial accounting is concerned with preparing information for users outside the organisation. For example, suppliers, banks and other lenders may want to know about the company's profit potential; government agencies are concerned with regulating the business and collecting taxes. Management accounting, on the other hand, is designed to meet the needs of a particular company. These range from analysing costs - so that management knows exactly how much it costs to produce a given product and how well the business is performing - to financial planning, which involves forecasting sales, costs, expenses and profits and which enables management to spot problems and opportunities, and allocate resources rationally by developing a budget. Financial accounting is carried out by public accountants who are responsible for auditing the company's financial statements. These are called chartered accountants in the UK. They are independent of the business and provide an objective analysis of the statements before reporting them to shareholders, investors or tax officials. They also provide other financial services including management consulting and tax accounting. Management accounting is carried out by private accountants who are usually either employed or hired by the business itself or in certain cases by a government agency to supervise the company's accounting system and book-keeping staff and to generate and interpret financial reports. Book-keepers represent the most routine accounting function of recording all transactions (sales, purchases, loans, wage payments, etc). The highest-ranking financial accountants typically have the title of Controller or Financial Vice-President, and spend their time monitoring and cross-checking all financial data so that top management can be certain that the company is using assets to best advantage. All companies use an accounting system that records every transaction affecting assets (things which the company owns) and liabilities (things which the company owes). However, within a short period of time the numerous transactions recorded by a book-keeper are likely to mount up. In order to simplify the situation, accountants summarise the transactions by preparing a number of financial statements, the three most important of which are: • the balance sheet • the income statement (profit and loss account) • the statement of changes in financial position (cash flow forecast). |

Part III Finance Unit 9 Accounting

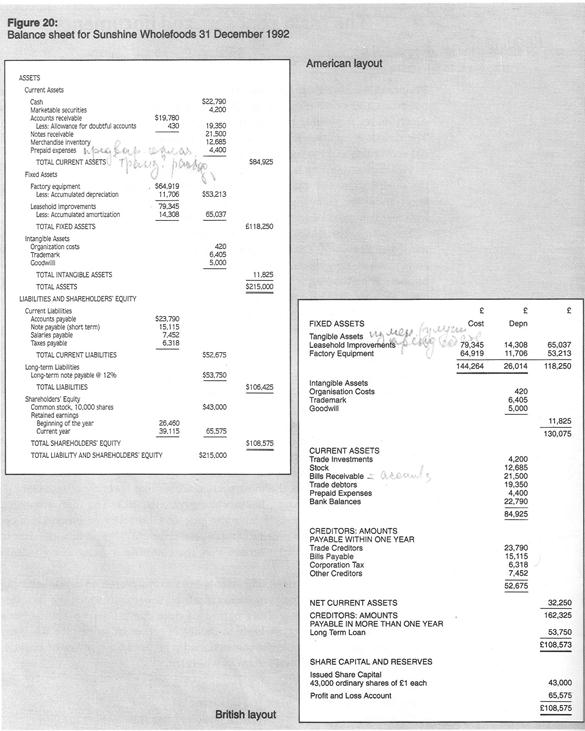

| Accountants in the UK have to prepare a further document called the Statement of Source and Application of Funds. The balance sheet The balance sheet is prepared at least once a year, at the end of either the calendar year or the fiscal year. It is often referred to as a picture of a company's financial position frozen at a given moment in time, and shows where the company's money came from (liabilities and owners' equity) and where it went to (assets). Figure 20 shows a simplified balance sheet in both American and British layouts. A glossary of terms appears on the next page. |

Terms and concepts

| Glossary | |

| current assets | Resources that can be converted into cash within one year |

| cash | Funds on hand or in bank accounts or savings accounts, and which can be withdrawn at short notice. |

| marketable securities | Any investment readily convertible into cash. |

| accounts receivable | Amounts owed by customers. |

| allowance for doubtful accounts | Some accounts receivable are unlikely to be paid and are therefore deducted. |

| notes receivable | Written and signed promises by customers to pay a stated sum on a certain date. The customer's bank is usually responsible for collection. |

| inventory | Assets tied up in things to be eventually sold - raw materials, goods in process (work in progress) and finished goods. |

| prepaid expenses | Services paid for but not yet used and which can be cancelled and turned into cash. |

| fixed assets | Resources you intend to keep, such as buildings, and which you need to run your business. |

| depreciation | The spreading out of the cost of a tangible asset over its useful life. For intangible assets the equivalent accounting procedure is called amortisation. Land is the only fixed asset which does not depreciate. |

| intangible assets | Assets having no physical existence but which can be licensed or sold to others. |

| goodwill | An intangible asset which corresponds to a company's reputation. When a business is purchased, goodwill represents the difference between the company's face value and the price that the purchaser is willing to pay. |

| current liabilities | Debts that the company will have to pay within one year. |

| accounts payable | Accounts that have to be paid within 30 days, usually to suppliers who have offered 30 days credit. |

| notes payable | Written and signed promises to pay a creditor a stated sum on a certain date. |

| accrued expenses | Expenses incurred but for which bills have not yet been received or recorded. Wages and salaries are examples of accrued expenses. |

| long-term liabilities | Debts that fall due more than a year after the balance sheet has been drawn up. |

| owner's equity | The figure which appears on the balance sheet represents the amount raised by the shareholders when the stock was issued. |

| retained earnings | All previous earnings minus the amount distributed as dividends. |

The income statement (profit and loss account)

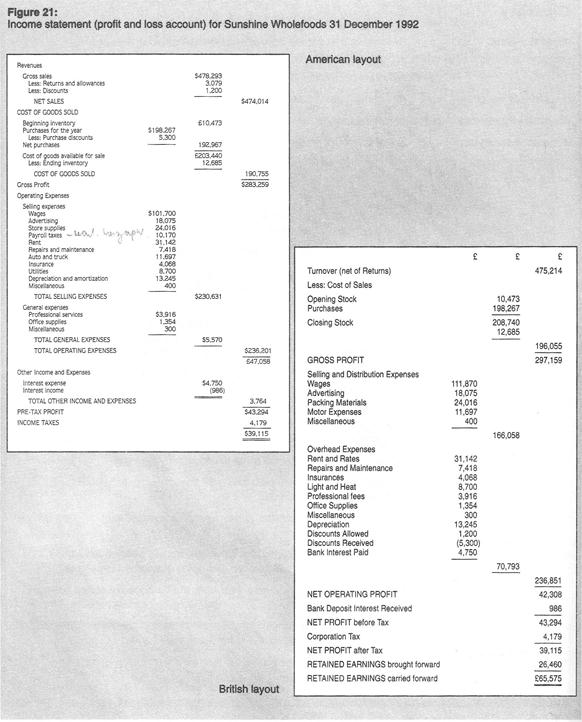

The income statement (US) or profit and loss (P & L) account (UK) is a kind of financial history book which summarises the company's financial operations over a period of time, usually one year. By subtracting all expenses from all revenues the income statement shows the company's net income at the end of the period. This net income is the company's profit and loss. By comparing net income for one year with net income for previous years, owners, creditors and investors can form judgments about the firm’s past performance and future prospects. A simplified income statement in both British and American layouts is shown in Figure 21.

Part III Finance Unit 9 Accounting

The statement of changes in financial position (cash flow forecast)

The statement of changes in financial position (US) or cash flow forecast (UK) shows the sources and uses of an organisation's cash during an accounting period. If the balance sheet is a picture of the company's present situation, and the P & L account its history book, then the cash How forecast can be described as the company's crystal ball offering projection of the company's future activities. It is extremely useful tor analysing whether future operations will provide enough cash to cover expenses or whether the company will need to turn to other sources of financing.

Terms and concepts

| 1 What is the difference between: · financial accounting and management accounting? · public accountants and private accountants? · a controller and a book-keeper? · assets and liabilities? · the P & L account and the cash flow forecast? 2 Match the following US and UK terms. |

| US | UK |

| 1 Statement of changes in financial position | a Finance Director |

| 2 Income statement | b Fixed asset investments |

| 3 Financial Vice-President | c Cash flow forecast |

| 4 Public accountants | d Bills of exchange payable |

| 5 Marketable securities | e Trade creditors |

| 6 Accounts receivable | f Chartered accountants |

| 7 Accounts payable | g Inventory stock |

| 8 Notes payable | h P & L account |

| 9 Merchandise inventory | i Trade debtors |

| 10 CEO | j Managing Director |

| 3 By referring to the documents presented on pages 110 and 112, explain how the following amounts are arrived at. The first one has been done for you. a Gross profit: net sales minus cost of goods sold b Net income: c Pre-tax profit: d Net profit: e Total assets: f Total shareholders' equity: |

Part III Finance Unit 9 Accounting

| 9.I.B Vocabulary | Defining key terms I Match the following terms with their definitions: Terms 1 financial accounting 2 management accounting 3 budget 4 public accountants 5 private accountants 6 audit 7 assets 8 liabilities 9 balance sheet 10 goodwill 11 income statement 12 book-keepers 13 controllers 14 accounts receivable 15 depreciation 16 cash flow forecast Definitions a concerned with preparing information for internal use b a financial blueprint of estimated revenues and expenses for a given period of time c people involved in record-keeping and other clerical jobs in accounting d a financial statement showing the sources and uses of an organisation's cash during an accounting period e concerned with preparing information for outside users f evaluation of the accuracy and reliability of a company's financial statements g statement of a firm's assets, liabilities and owners' equity at a specific moment in time h the highest-ranking accountant in a firm i the spreading out of a tangible asset's cost over its estimated useful life j accountants who are independent of the organisations they serve k the value of a business's reputation l valuable things owned by a company m debts or obligations the company owes n accountants employed by a business to supervise the accounting system o amounts due from customers p statement showing the firm's overall profitability 2 Divide into two teams. Each member of each team reads aloud a definition and asks one member of the opposing team to give the corresponding term. The person answering must not consult his or her notes and has five seconds to answer in order to earn a point. |

Terms and concepts

| 9.I.C Vocabulary |

Classifying

Make a copy of the grid below and place the following items in it.

1 three trucks

2 a patent on a new process devised by Calypso Potteries pic

3 12 tons of clay

4 interest due on a bank loan

5 mortgage

6 10,000 shares in the company

7 a lap-top computer for the CEO

8 taxes

9 a 'Calypso' trademark

10 three industrial kilns

11 an unpaid invoice for 600 dishes purchased last month by a Swedish department store

12 the lease on a warehouse

13 money in the company safe for day-to-day expenses

14 the copyright for the series of Calypso publications Pottery through the ages

15 unpaid invoice for last week's clay delivery

16 the unexpired portion of an insurance policy

|

Part III Finance Unit 9 Accounting

| 9.I.D Project | Drawing up a balance sheet and income statement From the following information prepare a balance sheet and an income statement (US layout).

|

Section 2

Creating accounting

| 9.2.A Summarising I | Avoiding plagiarism Plagiarism is presenting another person's words or ideas as if they were your own. Although occasionally intentional, it is more often due to the writer being unaware of what constitutes plagiarism. However, whether deliberate or accidental, plagiarism is seriously frowned upon in business, education, research, and in general. It is therefore essential to document the following: · direct quotations · opinions and judgements of the original author · facts that are not widely known, or universally accepted · statistical data. The following passage is an extract from an article which appeared in The Economist. Following the passage are five summaries, four of which are guilty of plagiarism. In each of these cases identify the specific violations of the plagiarism guidelines above. |

Creativity accounting

Summary 1 There are many accounting mechanisms which accountants can use, quite legally, in order to make the company's position look healthier. Using different methods of calculating depreciation, for example, or capitalisation of costs are commonly used ploys. Many big British companies have convertible bonds with put options which could prove costly if share prices fall. Accountants' failure to provide against this possibility could mean that shareholders will one day have a nasty shock.

Summary 2 There are many accounting mechanisms which accountants can use, quite legally, in order to make the company's position look healthier. Using different methods of calculating depreciation, for example, or capitalisation of costs are commonly used ploys. Many big British companies have convertible bonds with put options which could prove costly if share prices fall. Accountants' failure to provide against this possibility means that some companies could one day be reaching for their pockets - or those of their shareholders. Discounting for creativity - The Economist (19/01/91) Summary 3 There are many accounting mechanisms which accountants can use, quite legally, in order to make the company's position look healthier. Using different methods of calculating depreciation, for example, or capitalisation of costs are commonly used ploys. Many big British companies have convertible bonds with put options which could prove costly if share prices fall. Accountants' failure to provide against this possibility could mean that shareholders will one day have a nasty shock. Discounting for creativity - The Economist (19/01/91) Summary 4 There are many accounting mechanisms which accountants can use, quite legally, in order to make the company's position look healthier. Using different methods of calculating depreciation, for example, or capitalisation of costs are commonly used ploys. Many big British companies have 'convertible bonds with put options'1 which could prove costly if share prices fall. Accountants' failure to provide against this possibility could mean that shareholders will one day have a nasty shock. 1Discounting for creativity - The Economist (19/01/91) |

Part III Finance Unit 9 Accounting

| Summary 5 There are many accounting mechanisms which unscrupulous accountants can use in order to make the company's position look healthier. Using different methods of calculating depreciation, for example, or capitalisation of costs are commonly used ploys. Many big British companies have convertible bonds with put options which could prove costly if share price fall. Accountants' failure to provide against this possibility could mean that shareholders will one day have a nasty stock. Discounting for creativity - The Economist (19/01/91) | ||||

| 9.2.B Summarising 2 | Being brief and to the point Read the following passage and then write a summary of it in no more than 70 words. MEASUREMENT OF PROFITABILITY It has been argued that profitability is the primary aim and the best measure of efficiency in competitive business. However, profits as such are meaningless unless related to the equity (ordinary) shareholders' investment in the business. The relationship between the capital invested in a business and the profits earned is the rate of return on capital employed. The ability to earn a satisfactory rate of return on equity shareholders’ investment. Is the most important characteristic of the successful business. Increased sale volume is at best a short-term indication of successful growth, and, without additional information, must be viewed as such. In the long run, increased sales volume may prove a deceptive guidepost if there is not a proper return on the capital necessary to support these sales. Real growth comes from the ability of management to employ successfully additional capital at a satisfactory rate of return. This is the final criterion of the soundness and strength of a company's growth, for in a competitive economy capital gravitates towards the more profitable enterprises The company that is merely expanding sales at a declining rate of return on capita employed will eventually be unable to attract expansion capital. Thus any measurement of a company's effectiveness must be based on the successful employment of capital. J Sizer, An Insight into Management Accounting, Pelican (1975) | |||

| 9.2.C Vocabulary | Verbs and nouns in context

I All of the following verbs appear in this unit. Insert them in the gaps in the sentences below, conjugating them wherever necessary.

1 It was lucky she the mistake before the documents went up to the controller's office. 2 We've run out of cash. Could you go the bank and ___________________$150?

|

Creativity accounting

3 The management has just decided more resources to the R&D department.

4 We shouldn't too much of our capital in inventory.

5 He was concerned about how the new law our accounting procedures.

6 We've heavy losses but the prospects for next year are much better.

7 Our accounting system is to tightly control costs.

8 Unpaid bills have on his desk since he went on sick leave.

9 They're slow payers; they still us over $100 from the January order.

10 It's going to be tricky expenses when we're not even sure about next quarter's sales.

11 I would like you an objective analysis of the situation.

12 Property around here will never. It will probably double in value over the next five years.

13 Last year she a three-month accounting traineeship with Maple Leaf Enterprises.

14 It is essential for the company's book-keepers and _______________________every transaction made.

2 Find the nouns which correspond to the following verbs.

Example

3 Fill in the blanks in the following paragraph, using nouns from the previous exercise.

Here is a 1 of a Chairman’s 2 regarding the company’s 3 for the second quarter. In spite of new government 4, sales increased by 8%, leading to the 5 of higher profits. Although the 6 of sterling has led us to revise our 7 for the coming year, the 8 of an extra half a million dollars to the advertising budget and the 9 of our production process mean that next year we’ll beat every 10.

|

Part III Finance Unit 9 Accounting

| 9.2.D Vocabulary | Compound words I Match each of the words in the first column with words in the second column to make compound nouns. |

| 1 cross 2 finished 3 accrued 4 cash 5 crystal 6 accounts 7 current 8 notes 9 rights 10 balance 11 income 12 income 13 working 14 production 15 retained 16 fiscal | a sheet b expenses c receivable d statement e costs f earnings g ball h capital i goods j taxes k check l flow m issue n payable o assets p year |

| 2 Write a concise definition for three of the above terms without using a dictionary and without using the term itself. In small groups, read your definitions to each other. The other members of your group have to decide which term you are defining. |

Section 3

Controlling the cash flow

| 9.3.A Listening | Complaints, apologies and excuses I Listen to the tape recording of five conversations. Make a copy of the grid on the next page and fill it in as you listen. |

Controlling the cash flow

| Complaint | Excuse given | Resolution of problem | |

| Conversation 1 | |||

| Conversation 2 | |||

| Conversation 3 | |||

| Conversation 4 | |||

| Conversation 5 |

2 Reply to each of the following complaints by apologising and giving an appropriate excuse.

Example

Complaints 1 We ordered the goods 17 days ago and we've still not received them. 2 We've just received the consignment and part of it is missing. 3 You sent the order to 171 Broad Street. Our address is 71 Broad Street. 4 Mr Smith did tell me he'd phone early in the week but I've still not heard from him. 5 Listen, you've kept me holding on for over five minutes. 6 I've been trying to get through to your accounts department all day but the line's always busy.

3 Look at the previous exercise again. This time, after you have given your excuse, try to resolve the problem. The following expressions may be helpful.

· I'll get him to deal with it. · I'll get our transport department to deliver it straightaway. · I'll look into it immediately. · I'll ask one of our representatives to call in this week. · I'll deal with it myself. · Could you leave this with me and I'll call you back this afternoon?

|

Part III Finance Unit 9 Accounting

| 9.3.B Case study | Controlling cash flow Read the following case study and then answer the questions which follow it. Regal Leather is a small up-and-coming company producing top-quality leather bags and briefcases. The company has 10 workers, one Sales Manager and a Managing Director, Vincent Jones, whose responsibilities include looking after the company's accounts. Turnover for last year reached £1,800,000, which represented a 10% increase over the previous year and confirmed Regal Leather's growing importance in the industry. Production capacity for the land is currently 500 units per week over 48 weeks, plus 10% if overtime is introduced. The plant closes in September for four weeks. Mr Jones had just finished his morning coffee and was beginning to study the architects' plans for the new production wing when his Sales Manager, John Howard, walked into the office with a letter in his hand. 'Hi, Vincent', he said, 'Here, take a look at this', and he thrust the letter into Mr Jones's outstretched hand. Mr Jones read the letter carefully. |

|

|

|

|

|

Дата добавления: 2014-12-27; Просмотров: 555; Нарушение авторских прав?; Мы поможем в написании вашей работы!