КАТЕГОРИИ:

Архитектура-(3434)Астрономия-(809)Биология-(7483)Биотехнологии-(1457)Военное дело-(14632)Высокие технологии-(1363)География-(913)Геология-(1438)Государство-(451)Демография-(1065)Дом-(47672)Журналистика и СМИ-(912)Изобретательство-(14524)Иностранные языки-(4268)Информатика-(17799)Искусство-(1338)История-(13644)Компьютеры-(11121)Косметика-(55)Кулинария-(373)Культура-(8427)Лингвистика-(374)Литература-(1642)Маркетинг-(23702)Математика-(16968)Машиностроение-(1700)Медицина-(12668)Менеджмент-(24684)Механика-(15423)Науковедение-(506)Образование-(11852)Охрана труда-(3308)Педагогика-(5571)Полиграфия-(1312)Политика-(7869)Право-(5454)Приборостроение-(1369)Программирование-(2801)Производство-(97182)Промышленность-(8706)Психология-(18388)Религия-(3217)Связь-(10668)Сельское хозяйство-(299)Социология-(6455)Спорт-(42831)Строительство-(4793)Торговля-(5050)Транспорт-(2929)Туризм-(1568)Физика-(3942)Философия-(17015)Финансы-(26596)Химия-(22929)Экология-(12095)Экономика-(9961)Электроника-(8441)Электротехника-(4623)Энергетика-(12629)Юриспруденция-(1492)Ядерная техника-(1748)

Retailing 2 страница

|

|

|

|

| Company | Needs | Source(s) of funds |

| 1 Computer manufacturer (annual earnings 1992: $3 billion) | to buy new plant and equipment | |

| 2 Medium-sized car dealer | to buy 12 vehicles for immediate display in showroom (prime lending rate: 13%) | |

| 3 Small producer of kitchen furniture | to have enough ready cash to cover immediate expenses | |

| 4 Small manufacturer | to purchase 10 industrial drills | |

| 5 Large producer of skiing equipment with top credit-rating | to meet immediate expenses during off-season (prime lending rate: 18%) | |

| 6 Overseas electronics wholesaler with unknown credit rating | to buy a large consignment of VCRs | |

| 7 Clothes store with poor credit rating | to purchase stock for the summer season | |

| 8 Major oil company | to build a 1,000 km pipeline from a newly discovered oil-field to the sea | |

| 9 Loading chemical manufacturer | (forecast: two or three years before business takes off again) |

Part III Finance Unit 7 Raising capital

| 7.2.B Summarising I | Getting the message across In writing reports and memos, and in presenting information orally, we are often called upon to state or restate the main facts and arguments as briefly as possible. Match each of the following long sentences with a short sentence. Long sentences 1 It is probably quite true to say that to a certain extent the borrower's choice of options in financing a project depends in many cases on the probable cost of the project. 2 Raising funds through the sale of certificates of indebtedness is less onerous, financially speaking, than other ways of raising capital. 3 Individuals and institutions owning bonds in a particular company are not allowed to interfere in the way it runs its business. 4 There are many arguments for and against the decision by a company to obtain fresh capital through the sale of shares on the Stock Exchange. 5 Raising capital through borrowing from banks, individuals, companies or any other institution can turn out to be a costly operation at times when rates of interest tend to be high. Short sentences a The Stock Exchange cannot meet the needs of all companies. b When interest rates are high, any form of debt is expensive. c It is relatively easy to issue bonds. d Bondholders do not have any voice in management. e Bonds represent the cheapest type of financing. f Choosing a vehicle for financing a project often depends on the size of the operation. g Issuing stock has its pros and cons. h The choice of project a company undertakes depends on the capital it is able to raise. i Buying shares can be expensive. Why are the short sentences better models to follow than the long sentences? |

| 7.2.C Summarising 2 | Simplifying and reducing A good summary should: · be objective - your comments or opinions should not be included · be in your own words · include only essential material · be concise - it should be no longer than one-third of the original work and may be as short as one sentence. Rewrite each of the following sentences, preserving the essential meaning, in a maximum of one-third of the original number of words. 1 It is undeniably the case that the growing number of consumers who purchase goods and services using any one of a number of credit cards has led to a situation where banks are reaping huge profits. (36 words) 2 It is most regrettable that there is clear evidence which indicates that certain consumers in our society are purchasing more than they can afford due to credit cards. (28 words) |

The sources of funds

| 3 It would appear reasonable to assert that more stringent measures need to be set up and put into practice by the banks themselves if we are not to witness the tragedy of growing numbers of families being forced into a situation of living in a state of permanent indebtedness. (49 words) 4 It really was totally and utterly irresponsible of loan managers from banks throughout the United States as well as Western Europe and Japan to have acted in such a way as to extend large-scale credit facilities to undeveloped and developing countries whose economies simply have not been able to support the enormous burden of interest repayments. (57 words) | |||

| 7.2.D Vocabulary | Verbs and nouns in context I Match the phrases on the left with those on the right to make complete sentences. | ||

| 1 We should be able to meet... 2 We'll need to raise... 3 If we don't use our reserves, we'll simply have to take on... 4 If you buy on hire purchase, you have to put down... 5 It may be more expensive to pay by... 6 We'll ask our supplier to draw up... 7 It will work out very expensive to factor... 8 Let's lease... 9 I hope they don't default... 10 Instead of giving a dividend this year, why don't we plough back... | a on the loan. b our accounts receivable. c all the profits. d our expenses this year. e a deposit. f funds for the expansion programme. g a trade draft. h instalments. i all the vehicles. j more debt. | ||

| 2 Find the nouns which correspond to the following verbs. Example | |||

| To indicate → indication | |||

| 1 to repay 2 to extend 3 to purchase 4 to reap 5 to acquire 6 to discuss 7 to avoid 8 to vary 9 to agree 10 to promise 11 to back 12 to fail | 13 to seize 14 to require 15 to negotiate 16 to sell 17 to distribute 18 to divide 19 to lease 20 to own 21 to expect 22 to specify 23 to earn 24 to rate | ||

Part III Finance Unit 7 Raising capital

| 3 Fill in the blanks in the following paragraph, using nouns from the previous exercise, so that it respects the meaning of the paragraph which follows. 'The 1 of the government to provide sufficient 2 for the project has led to a 3 among the members of the Board of Directors. Some want to reopen 4* with the government in the hope of obtaining more cash, while others feel we should ask the banks for a(n) 5 of the 6 of the loan. My main worry is that if neither plan works, we'll have to consider the 7 of our American operations which will lead to a major loss of 8. Hopefully, though, we'll come to some kind of a(n) 9 before long. *two possibilities 'The government has not funded the project sufficiently and the Board is now split over whether to try again or ask the banks to restructure the debt. I'm concerned that if we don't come up with a solution, we may have to discontinue our business in the States, with the resulting drop in income. Let's hope we can sort something out soon!' | |

| 7.2.E Discussion | Sayings

Each language has 'sayings' about money. Discuss the ideas behind the English sayings shown below. Translate similar sayings about money from other languages you know and compare the advice they offer.

|

UNIT 8

Investing

Section I

Investment options

| 8.I.A Reading | Investment options Read the following article from 'Investment Quarterly' then work on exercises 8.I.B and 8.I.C. Purchasing plant, machinery, management contracts, patents, and other real assets is necessary if companies are to grow and remain competitive. Investment decisions such as these are based on the need to find assets which are worth more than they cost and which are worth more than other investments. Calculating how much a real asset is worth is often a difficult task. Unlike securities investments which are traded in highly active markets, the market for most corporate investments is relatively thin; for example, it is not often that one comes across advertisements in The Financial Times to sell an oil refinery, buy a second-hand blast furnace, or exchange a patent. Financial managers are therefore called upon to analyse mountains of raw data supplied by armies of specialists in product design, production, marketing and so on, in order to make forecasts upon which their investment decisions will be based. But even where a flourishing market does exist, the choice of investment is not easy as the number of investment products on the market has increased dramatically over the past few years. Before investing your money you need to analyse your resources and objectives. Determining what you are looking for in terms of income, growth, safety, liquidity and tax benefits will help you develop an efficient investment strategy. If you are looking for a steady income from your investment the best strategy would be to choose low-risk vehicles - bank deposits, Government securities, high-grade corporate bonds and stock - which pay interest or dividends on a regular basis. If, however, you are more interested in growth you may be better off choosing an investment which maximises the potential for capital gains. Stocks, real estate, precious metals or works of art may be the answer, although this depends very much on the prevailing economic conditions. In general, the higher the potential for income or growth, the greater the risk of the investment. For example, the rate of return on junk bonds tends to be high, but so are the risks. If liquidity is important to you - in other words, if you may need to convert the investment into cash soon - you should invest in something the price of which does not fluctuate too much. If not, you may have to sell when the market is down. Stocks Stocks can earn money in two ways: by paying dividends and through capital gains. Blue chip stocks are issued by large, well-capitalised companies that have consis-tently paid good dividends. On the other hand, stocks which offer high capital gains are more difficult to identify. The likelihood of a particular stock increasing in market value depends on a variety of factors, not least of which is the condition of the market as a whole. Stock prices tend to rise and fall as the economy expands and contracts. A 'bear' market is characterised by falling share values and generally. |

Part III Finance Unit 8 Investing

| occurs during recessions. A 'bull' market, on the other hand, is associated with economic booms and is characterised by rising share prices. Corporate bonds Corporate bonds offer income in the form of interest plus the possibility of making capital gains. Although corporate bonds are relatively safe investments, their face value can fluctuate, and may go down as well as up, thereby leading to a capital loss. However, this may not matter much to investors whose objective is to receive regular interest; the capital loss only occurs when the bond is sold and such investors may have no intention of selling. Government securities Federal and state governments also issue bonds which, generally speaking, carry a lower rate of interest than corporate bonds but provide advantages in terms of safety and tax advantages. In the US, the main government securities are as follows: · Treasury bills (T-bills) are sold by the US government at a discount and redeemed at full face value at maturity, which ranges from 91 to 364 days from the date of issue. A minimum investment of $10,000 is required. · Treasury notes and bonds have longer maturity dates than T-bills and pay a fixed rate of tax-free interest twice a year, which is generally about one percentage point less than the interest on corporate bonds. A minimum investment of $1,000 is required. · Savings bonds are available in denominations ranging from $50 to $10,000. Although savings bonds can be sold at any time, the interest rate is higher if the holder keeps them for at least five years. · Municipal bonds are tax-free investments issued by a town or city to help finance new public services. Many investors have become dissatisfied with municipal bonds, especially since a number of issuers defaulted on the repayments. Mutual funds A mutual fund is an investment company where small investors pool their money. This money is then used to acquire stocks or bonds or other financial investments. Small investors who have neither the time nor the know-how to invest rationally can benefit from the broad selection of investments which the fund is able to acquire. Mutual funds generally offer liquidity. They also offer variety and, in many cases, are tailored to specific objectives, for example, tax-exempt funds, high-growth funds, utility funds, money market funds and so on. Commodities Commodities are raw materials and farm produce used to produce finished goods. Producers and manufacturers need to hedge their risks and therefore follow very closely the fluctuations in the prices of the raw materials they produce or use. Contracts calling for the delivery at a given time of a set amount of these commodities are traded at Commodity Exchanges. The trade represents a shift in risk from the hedger to the speculator. Nowadays, many commodity traders are neither producers nor consumers but merely investors who will never take possession of the commodity. The commodity market is divided into 'spot trading' (for commodities that will be delivered immediately) and 'futures trading' (for commodities that will be delivered at a future date). Financial futures Investors in financial futures trade contracts for the delivery or acceptance of some financial instrument on a set date at a set price. Examples of financial instruments are Government securities, foreign currencies, loans, stock index futures and stock index options. Most financial futures are traded on 'the margin', a particular kind of leverage which means that the investor borrows from the broker, paying interest on the borrowed money and leaving the security with the broker as collateral. |

Investment options

| 8.I.B Vocabulary | Defining key terms Match the following terms with their definitions. Terms 1 institutional investors 2 capital gains 3 speculators 4 rate of return 5 blue chip stocks 6 bull markets 7 bear markets 8 S mutual fund 9 commodities 10 spot trading 11 futures trading 12 financial futures 13 hedgers 14 leverage 15 to default Definitions a Promises to buy or sell financial instruments at a future date. b Companies that invest money entrusted to them by others. c Trading in commodities that will be delivered at a future date. d Raw materials used in producing other goods. e Difference between the price at which a financial asset is sold and its original cost (assuming the price has gone up). f Percentage increase in the value of an investment. g Falling stock markets. h Investors who seek large capital gains through relatively risky investment. i Company that sells shares to the public and uses the pooled money to buy stocks, bonds, or other financial investments. j Equity instruments issued by large, well-established companies and paying relatively stable dividends. k Rising stock markets. l Trading in commodities that will be delivered immediately. m People who protect themselves from major fluctuations in prices which may lead to loss. n The use of borrowed funds to finance a portion of an investment. o Failure to pay back a debt. |

| 8.I.C Discussion | Where to invest 1 From your background knowledge, find examples of: · institutional investors · commodities · blue-chip stocks · real estate. 2 We are sorry to inform you that your Uncle Tom has passed away at the age of 103. You will, however, be pleased to know that he has left you $20,000 in his will. You have no immediate needs so you have decided to invest the money. Explain to the class how you will invest the money. Justify your choice(s). |

Part III Finance Unit 8 Investing

3 You are an investment consultant. Advise the following people on the best investment option(s).

| Name | Age | Marital status | Profession | Size of investment | Other information |

| John McGregor | Single | Student | $12,000 | Hopes to get married in two years' time | |

| Anne Davies | Widow, no children | Secretary | $25,000 | Receives a small widow's pension | |

| James Black | Married, two children | Engineer | $100,000 | Owns some real estate and wants to diversify | |

| Marilyn Dangerfield | Married, children grown up | None | $150,000 | Hopes to retire to Miami when she can afford to | |

| Martha Leclerc | Married, four children | Owner and managing director of a company producing saucepans | $500,000 | Worried about the effects that a rise in copper prices will have on her business |

| 8.I.D Role play | Consulting Work in pairs. One student will play the role of investment consultant, while the other is the client. Prepare and present a short role play in which the consultant obtains information about the client's background, resources and needs and then advises him or her on the most appropriate investment. The following expressions may be useful: · What can I do for you? · What size investment were you thinking of? · How much risk are you prepared to take on? · I'm looking for a high-yield investment. · I want access to my capital at short notice. · I want to put some money by for my daughter's university education. |

Investment options

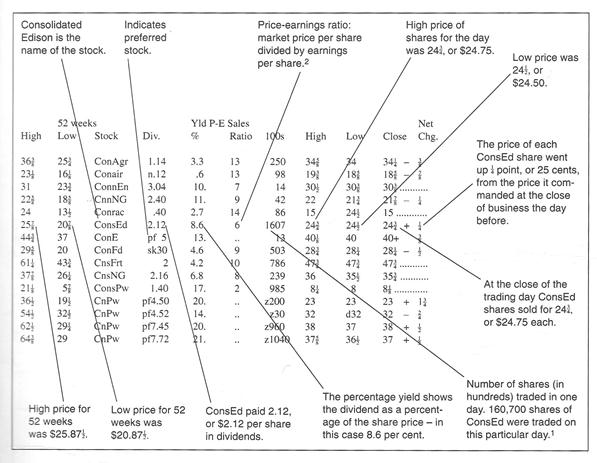

| 8.I.E Project | Analysing the stock market In small groups, carry out the following analysis activities. 1 Choose an industry such as banking, electronics, food, manufacturing and so on. Select five companies within that industry the stock prices of which are listed in the The New York Times or The Financial Times. 2 Read the financial section of a good newspaper over one week and keep any articles regarding your chosen industry and companies. 3 Track the daily performance of your chosen companies over one week, using the guidelines below. |

1 The volume of trading may give you a clue to developing trends. For example, if the stock market is down on heavy volume, it may mean that investors are selling before prices fall even further - a strong 'bearish' sign.

2 Stocks in the same industry tend to have p/e ratios that are roughly the same. A high p/e ratio is not necessary good or bad, it is only significant in relation to other companies' p/e ratios. If the p/e ratio is significantly below the industry norm, it could either mean that the company is having problems or that it is an undiscovered gem.

4 Compare the performance of your companies with others in the industry. Compare also with an appropriate index (Dow Jones, FT, S and P 500, etc)

5 Present your findings to the class in a short talk (maximum five minutes) and conclude by making investment recommendations.

Part III Finance Unit 8 Investing

Section 2

The securities market place

| 8.2.A Listening | The Commodities Exchange Center, New York I Listen to the tape recording of a guide talking to a group of Korean business people at the Commodities Exchange Center (CEC) in downtown Manhattan. Answer the following questions. 1 List the four independent exchanges that trade at the CEC. 2 Where does the trading actually take place at the CEC? 3 One of the CEC's major functions is to fix prices. What is the other? 4 Who are the hedgers? 5 Does a speculator need a large amount of capital in order to invest in futures contracts? 6 Does the speculator generally want to take possession of commodities? 7 How is the price of each contract determined? 8 Which financial futures are mentioned? 9 What is meant by options trading? 10 How do the brokers communicate with each other on the trading floor? 11 How is the latest price information communicated? 2 Fill in the grid below to show the various steps in a commodity transaction. |

| Person | Action |

| Customer | |

| Transmits the order to the trading floor | |

| Writes the order on an order ticket | |

| Runner | |

| Notes the details of the trade | |

| Runner | Returns order ticket to phone clerk |

| Phone clerk | |

| Phone clerk | Reports execution of trade back to broker |

The securities market place

| 8.2.B Functions | Explaining and giving instructions Explain one of the following activities to your partner. · how to buy stocks · how to withdraw cash from an electronic cash point · how to programme a VCR · how to copy information from one computer disk to another · how to make an international call from a public phone · how to enrol at a university · how to prepare for an overseas assignment. You may find the following expressions useful: |

| · First of all... · Be careful not to... · Don't forget to... · Make sure you... · The ______ works as follows... · If you don't _______ you'll... | · You('ll) have to... · You ought to... · You should... · You must... |

| 8.2.C Reading | The London Stock Exchange I Read the following text about the London Stock Exchange and take notes on the following points: · its origins · its functions · the Big Bang. The London Stock Exchange is a marketplace - indeed, it is one of the most important markets for stocks and bonds in the world. Like many other famous British institutions, the Stock Exchange was not created overnight; no edict or constitution brought it into being. It developed stage by stage, adapting as it did so to changing economic conditions and needs. In the seventeenth century, trading firms and governments needed to raise money for their expanding activities - more money than they could obtain from their usual sources. They did this by issuing stocks and shares and inviting the public to buy them. This provided the necessary capital. If the company made a profit, the shareholders received a share of it. If the shareholders wanted to get back the money they had invested, it was not possible to go to the company and ask for it. Instead they had to find somebody interested in buying the shares from them. A regular market therefore began to form. At first, the brokers used to meet at the Royal Exchange. Then, in the eighteenth century they began to meet in London coffee houses where business was carried out over a cup of coffee or a glass of madeira wine. In 1773, the market moved to a building of its own and the volume of trade increased steadily so that the London Stock Exchange became the largest in the world and remained so until the First World War. During the Industrial Revolution, other share markets had developed in other parts of the country, but by 1973 they had amalgamated to form the Stock Exchange of Great Britain and Ireland, and celebrated the event by moving into |

Part III Finance Unit 8 Investing

| a brand new tower block in the heart of the City of London. The next milestone in the history of the Exchange was on 27 October 1986 in an event which came to be known as the Big Bang. Basically, the Big Bang was a deregulation of the Stock Exchange. Until then, the Stock Exchange had been operating a system of restrictive practices under which, for example, it was virtually impossible for foreigners to become members of the Stock Exchange. It was a little like a very exclusive club whereby members could choose who would and who wouldn't be allowed membership rights. Obviously this absence of real competition led, amongst other things, to the members charging their customers higher commissions than would otherwise have been the case. So, the first major change which the Big Bang brought about was the opening up of the Stock Exchange to outsiders. This was done by ending the distinction between brokers (who execute transactions on behalf of their customers) and jobbers (who buy and sell on their own account to make a market in one or more stocks). Secondly, the Stock Exchange ended the practice of fixed minimum commissions on transactions. This means that investors are now free to negotiate commissions with traders. The consequences of these changes are far-reaching. Firstly, the difference between trading on the floor and off the floor has been eliminated. In fact much of the trading has now been moved off the trading floor. This has been helped, of course, by the greatly increased use of electronic trading. In the long-term this trend may lead to the London Stock Exchange becoming less important as investors will be able to make their own markets by dealing with each other directly either by phone or by computer. Secondly, the admission of outsiders has led to a flood of foreign institutions moving into the City. Japanese and American banks, in particular, have been attracted because in both the US and Japan there are laws which ban commercial banks from dealing in stocks. Faced with overwhelming competition from such institutional investment giants as America's Salomon or Japan's Nomura, some much smaller British firms are in danger of being crushed on their own territory. Others are managing to survive by concentrating their resources on the specialities they can excel in. In spite of these changes, the City has benefited and will continue to benefit from the Big Bang. The high concentration of foreign institutions could transform the City into the hub of a new worldwide computer-linked network of dealers trading US, Western European and Japanese and American stocks independently of any exchange floor. London is, of course, the natural centre for such a network because of its geographical location within a time zone that suits both Japanese and American traders. Also, British tax officers are not too curious about foreigners' financial affairs. There is also a tremendous pool of talent in London, with a lot of people who know how to trade in world markets. And, last but not least, London is the natural choice because of the fact that English is commonly used throughout the world. 2 Design a one-page overhead transparency which could be used to accompany an oral presentation of this information. |

The securities market place

| 8.2.D Presenting | Presenting an organization In small groups, prepare and present a short talk (five minutes maximum) on an organisation of your choice (a company, school, university, trade union, etc). In the very limited time you have available, try and cover the following points: · its origins · its activities · a recent important event. | |||||

| 8.2.E Listening | Yesterday's trading at the London Stock Exchange Listen to the account of yesterday's trading and say what happened or is happening to the following: · Wall Street · US employment data · UK equities yesterday · UK equities in the short-term · fund managers · sterling · UK base rates · Footsie · yesterday's trading. | |||||

| 8.2.F Grammar |

Linking sentences

Fill in each of the gaps below by using one of the following conjunctions:

1 We put our money in property,the property market crashed we lost practically everything.

2 we came into an inheritance, we decided to buy some shares to have a nest egg for our old age.

3 our house was paid for I wanted to speculate my husband had warned me against it.

|

|

|

|

|

|

Дата добавления: 2014-12-27; Просмотров: 466; Нарушение авторских прав?; Мы поможем в написании вашей работы!